Mixed trading dominated gold prices yesterday, to be content with recording the first target of the previous technical report, at 1758, and approaching by a few points from the second target, 1767, recording the highest at 1764.

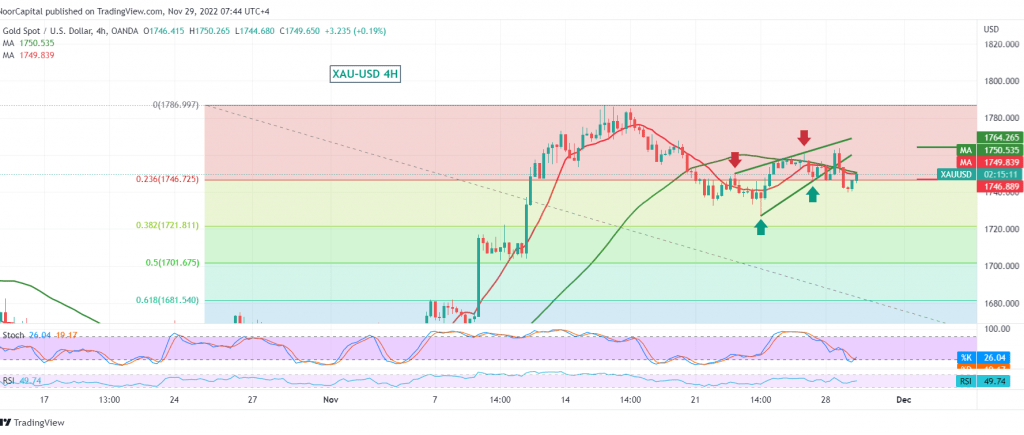

Technically, gold prices retreated to the downside to test the floor of the pivotal support published yesterday at 1745, and the prices are still stable above. With careful consideration of the 4-hour interval chart, we find the 50-day simple moving average that started to pressure the price from above and to the side; on the other hand, there are signs of positive signs coming from the stochastic indicator, in addition to the intraday stability above 1745, Fibonacci correction of 23.60%.

Although we tend to be positive, we prefer to monitor the price behaviour due to conflicting technical signals, waiting for one of the following scenarios:

Confirmation of breaking 1745 leads gold prices to a daily bearish trend; its initial target is 1738, while its official target is around 1726.

The bullish track’s return requires witnessing the breach of 1762, which is a catalyst factor that enhances the chances of the rise returning towards 1774, and 1786 is an official station.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations