The technical outlook is unchanged, and there was no significant change in gold prices in an attempt to rise. However, it is still limited, recording its highest level of 1898, after recording its lowest price around the support of 1885.

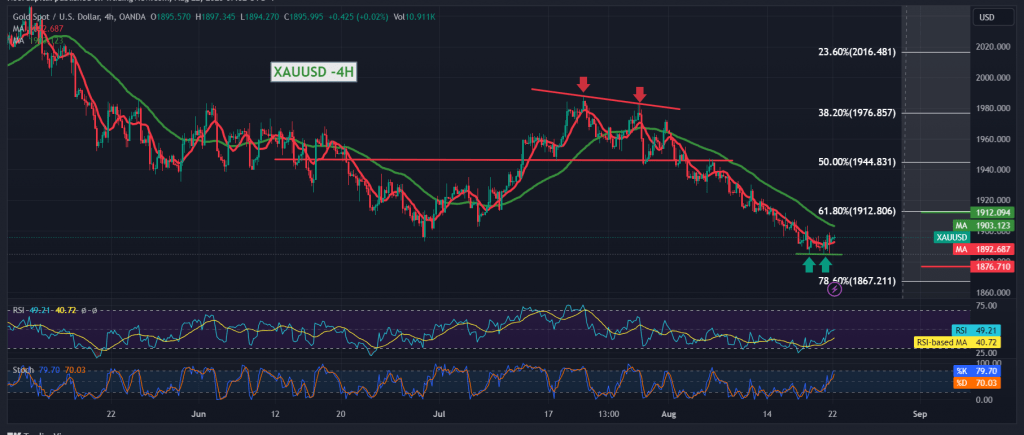

Today’s technical vision indicates the possibility that we will witness an attempt to establish support around 1885 that may lead gold prices to achieve some temporary rise, and this does not contradict the general bearish trend; with close consideration, the simple moving averages continue to exert negative pressure on the price from above, in addition to the signs of saturation. Clear buy on stochastic.

The continuation of daily trading stability below the main resistance at 1913, the previously broken support, and now converted to the Fibonacci correction resistance level of 61.80%, the bearish scenario remains the most preferred, provided that we witness a clear and strong break of the support level of 1885, targeting 1875 and 1873, next official stations that may determine the next directional movement.

The upside move and the price’s consolidation with the closing of the 4-hour candlestick above 1913, postpones the chances of a decline. Gold prices may witness a temporary recovery with the aim of re-testing 1922 and 1929, and the gains may extend later towards 1940.

Note: Today, we are waiting for the summit of the Bricks, and we may witness high price fluctuations.

Note: Today, we are waiting for the summit of the “BRICS” group throughout the day, and we may witness high fluctuations in prices.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations