Gold prices achieved a positive outlook, as we expected during the previous technical report, touching the first target to be achieved, at the price of $1936, recording its highest level of $1937 per ounce.

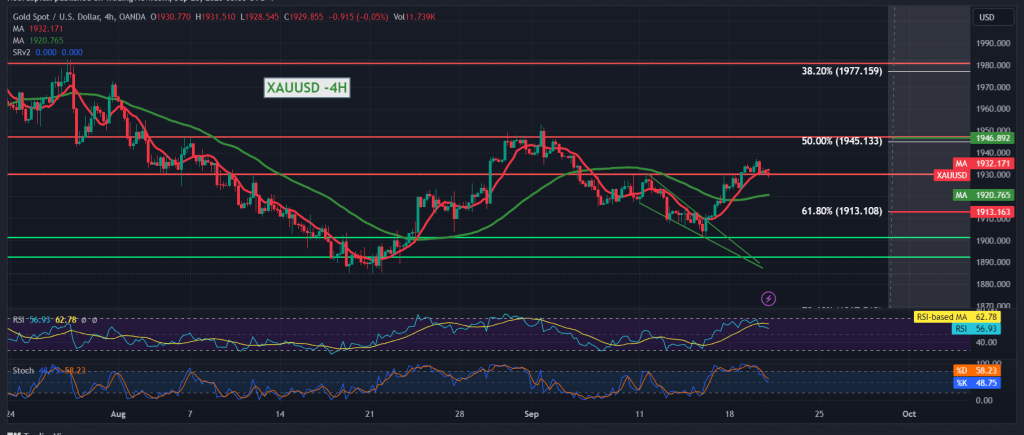

Technically, gold prices found a strong resistance level represented by the first target, 1936, which forced it to retest the 1929 support level and stabilize around it. With a closer look at the 4-hour time interval chart, we find the 50-day simple moving average still carries the price from below, stimulating it—the beginning of positive signals starting to appear on the Stochastic indicator.

This encourages us to maintain our positive expectations, considering that the price’s consolidation above 1936 is a motivating factor that leads gold prices to visit the second target, 1945, an awaited official station, and the gains may extend later to visit 1955.

Below $1922, with the closing of an hour candle below, it can thwart the bullish scenario and lead gold prices to retest the main support for the current trading levels at 1913. It should also be noted that breaking 1913 increases and accelerates the downward slope, opening the way directly towards 1900.

Note: Today, we are awaiting high-impact economic data issued by the American economy “the Federal Reserve Committee statement, the interest rate decision and forecast, followed by a press conference. We may witness high price fluctuations at the time the news is released.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations