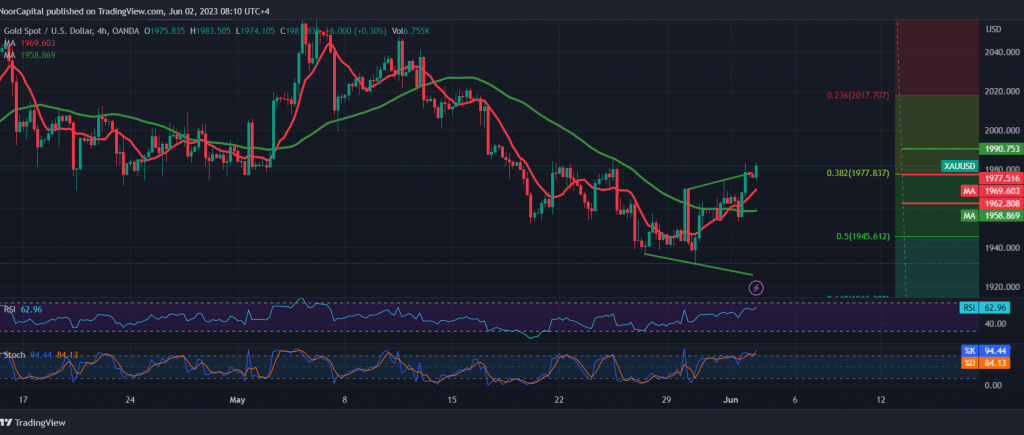

We adhered to intraday neutrality over the past two sessions due to the conflicting technical signals, explaining that we are waiting for the pending orders to be activated by breaking 1945 or breaching 1977, so that gold movements witnessed an upward trend during yesterday’s session to start activating the awaiting buy order above 1977, explaining that the price’s consolidation is above the main resistance of 1977. Therefore, it can enhance the chances of a rise towards 1990, recording its highest level of $1983 per ounce.

Technically, and by looking at the 240-period chart, we find the 50-day simple moving average that supports the possibility of an incline during the session, in addition to trading stability above the main resistance of 1977, Fibonacci correction of 38.20%.

Therefore, the possibility of resuming the rise is present and effective, targeting 1990/1992, knowing that confirming the breach of 1992 increases and accelerates the strength of the bullish tendency, paving the way directly for the visit of 2002, and the gains may extend towards 2010.

From below, the return of trading stability below 1977 postpones the chances of a rise but does not cancel it, and we may witness a re-test of 1962 before determining the next price destination.

Note: Today we are awaiting high-impact economic data issued by the US economy “US jobs data”, “average wages” and US unemployment rates, and we may witness a high fluctuation in prices at the time of the news release.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations