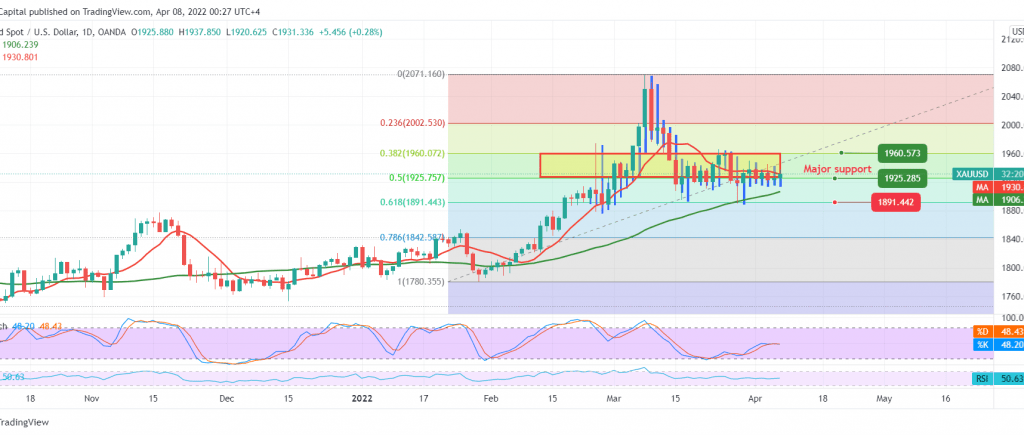

Gold prices are trying to record rebound attacks to the upside, but without change, and are trading within a sideways range, as we indicated in the previous analysis, confined between 1925 support level and 1940 resistance level, which managed to cap gold’s gains during yesterday’s session, recording 1940, unable to break it.

Technically, gold is witnessing stability above 1925 represented by the 50.0% Fibonacci correction, which increases the possibility of an upward bias accompanied by the occurrence of the 14-day momentum indicator towards positive signs, and on the other hand, gold trading is still stable below the main resistance 1940 accompanied by continued pressure The negative from the 50-day moving average.

With the conflict of technical signals and the confinement of trading in a side price range confined from the bottom above 1925 and from the top below 1940, we prefer to wait to be waiting for the following pending orders:

The resumption of the decline depends on closing a 4-hour candle below 1925 to target 1918 and 1906 next stations, knowing that the official target to break the 1925 support level is around 1891, the 61.80% Fibonacci correction, while consolidation above 1940 increases the possibility of retesting 1948, and the gains may extend later towards 1960.

Note: The risk level is high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations