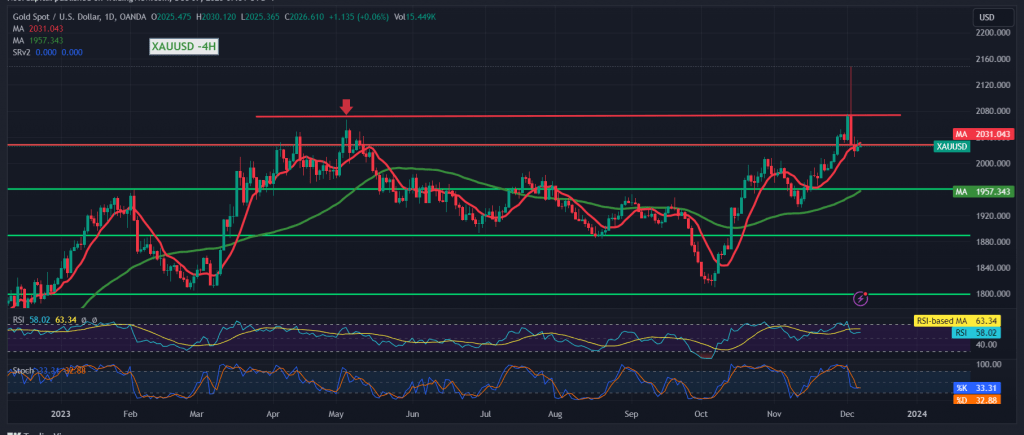

Gold prices are currently exhibiting a persistent negative trend, with limited fluctuations noted in the preceding trading session. Notably, the price has momentarily stabilized below the critical resistance levels of 2035 and, more significantly, 2040.

Technically, a scrutiny of the 4-period chart reveals an ongoing negative cross of the simple moving averages, exerting top-down pressure on the price. This is complemented by the emergence of adverse signals on the Stochastic indicator. It is worth highlighting the price’s attempt to leverage the 2009 support level.

In our trading approach, a cautious negative stance is adopted, with an initial focus on 2007 and subsequently 2000 as pivotal points. It’s crucial to acknowledge that a confirmed breach of the psychological barrier at 2000 may subject the price to substantial downward pressure, targeting 1992.

As a point of consideration, a reversal in trend could be initiated by an upward breakthrough, accompanied by the consolidation of the price for at least an hourly candle above 2040. Such a development would promptly arrest the downward trajectory, prompting anticipation of gold reaching levels around 2056 and 2073.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations