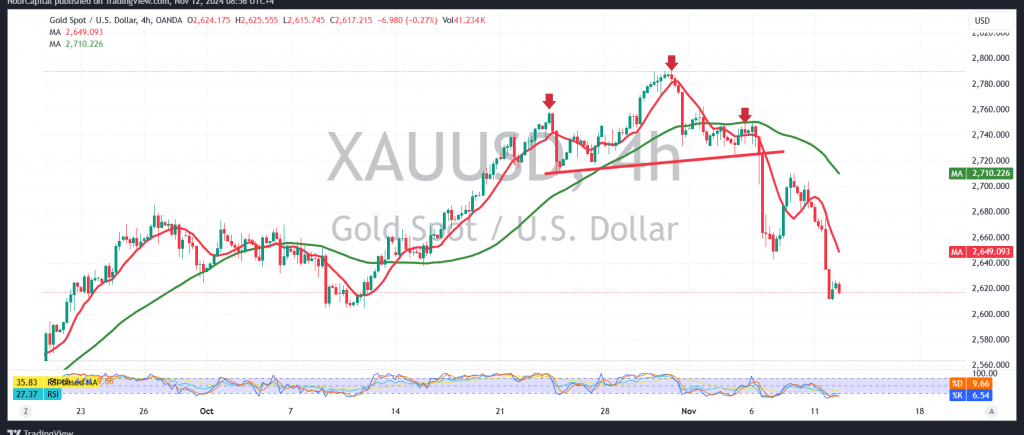

Gold experienced strong selling pressure, maintaining its downward trend and surpassing the target station of 2647, with prices dropping to a low of $2610 per ounce.

Technical Analysis:

- Bearish Outlook: Today’s analysis indicates a continued bearish sentiment, as gold remains below the simple moving averages, which reinforce the likelihood of further losses. The trading stability below 2647—a level now acting as resistance after a role exchange from previous support—supports this negative outlook.

- Key Levels: To confirm the continuation of the downtrend, gold needs to remain below 2647, with 2600 as the next target. Breaking below this level could accelerate the decline, opening the path to 2588.

- Upside Potential: On the flip side, a breach of 2647 could trigger a recovery, setting an initial target at 2665. Further gains could extend towards 2713, but this would require a solid break above resistance.

Warnings:

- High Risk: Given ongoing geopolitical tensions, the risk level remains elevated, and price volatility could be significant. Caution is advised, and it is essential to manage risk appropriately.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations