Gold prices managed to achieve the first goal published during the last analysis in 1918, after it succeeded in touching the support floor of 1925, as we explained previously, recording its lowest price in 1917.

Gold’s movements are still stuck within a sideways range, as we mentioned during the previous analysis, between support level of 1925 and from above below the level of resistance of 1940, which succeeded in limiting gold’s rises during yesterday’s session, recording 1940, unable to break it until now.

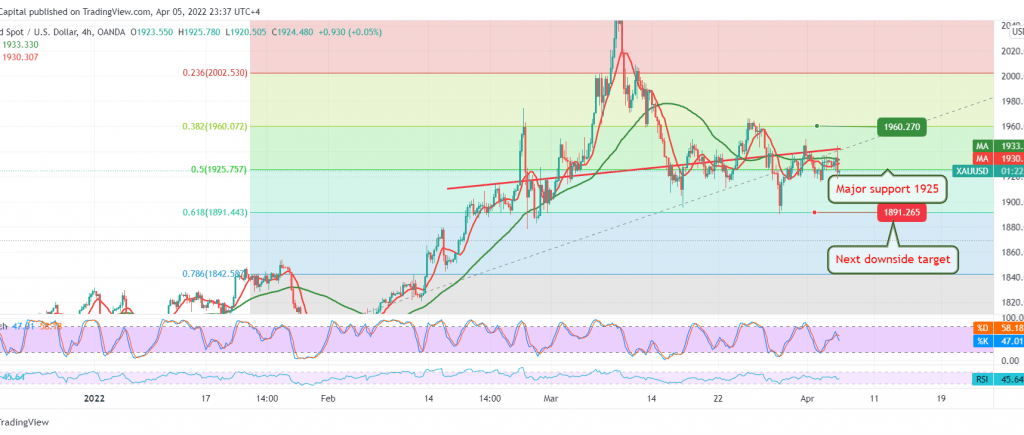

Technical Vision The intraday movements of gold are witnessing a return to stability above 1925, represented by the 50.0% Fibonacci correction, which increases the possibility of a bullish bias. On the other hand, gold trading is still stable below the minor resistance 1936, accompanied by negative pressure from the 50-day moving average.

With the conflict of technical signals and the confinement of trading in a side price range confined from the bottom above 1925 and from the top below 1940, we prefer to wait for the activation of the following pending orders:

The resumption of the decline depends on closing the 4-hour candle below 1925 to target 1918 and 1906 next stations, knowing that the official target to break the 1925 support level is around 1891, the Fibonacci retracement of 61.80%, while consolidation above 1940 increases the possibility of retesting 1948, and the gains may extend later towards 1960.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations