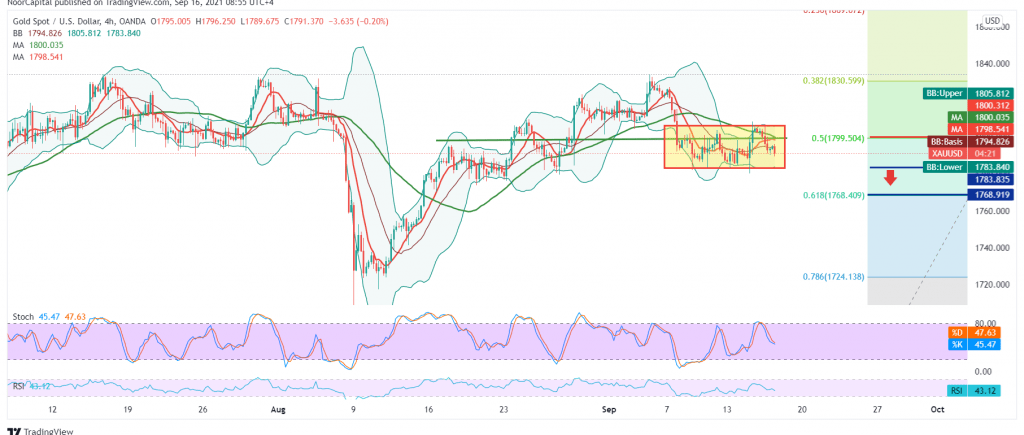

Gold prices witnessed negative trades during the last trading session to close below the critical resistance of 1799.

On the technical side today, we notice here a contradiction in the technical signals between the negative pressure of the 50-day moving average, which presses the price and meets around 1799/1800, and between the positive features that started to appear on the stochastic indicator on 4-hour time frame.

With the technical signals conflicting, we will stay on the fence until the daily trend becomes clearer, waiting for one of the following scenarios:

Activating long positions requires witnessing stability above 1799 50.0% Fibo, enhancing the chances of touching 1808 and 1812, respectively.

Activating short positions requires witnessing stability below 1799, in addition to the strength of trading below 1788, targeting 1784 first target, taking into account that breaking the latter puts the price under intense negative pressure, its marks are at 1778 and 1768, 61.80% correction.

| S1: 1784.00 | R1: 1799.00 |

| S2: 1778.00 | R2: 1812.00 |

| S3: 1768.00 | R3: 1818.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations