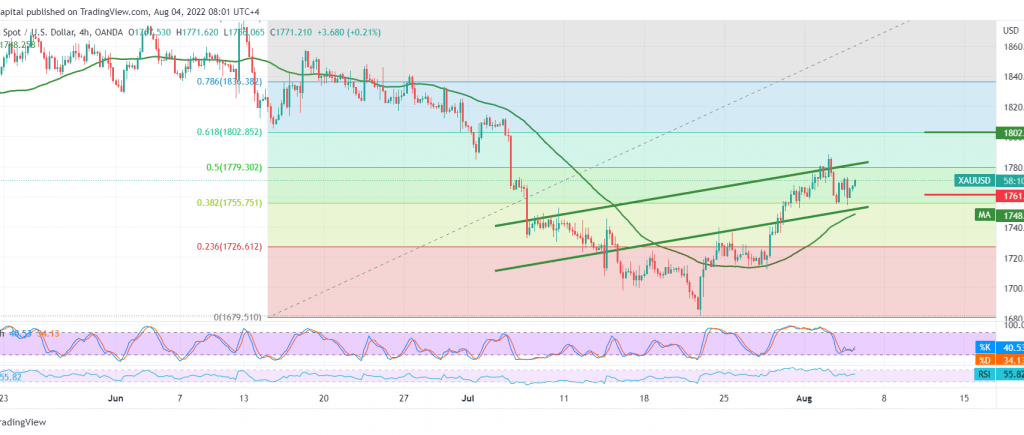

The yellow metal did not show much change during the last trading session within a sideways range, through which it succeeded in intraday stability above the 1760 support level and in general, above 1750; the price is now hovering near its highest level during the morning trading around 1770.

Technically, by looking at the 4-hour chart, we notice that gold continues to obtain a positive motive from the 50-day simple moving average, which coincides with the clear positive signs on the stochastic indicator.

Although we tend to be positive, we prefer to confirm the breach of the 1779 resistance level, the 50.0% correction, which will facilitate the task required to visit 1783 and 1794, respectively, and the gains may extend later to visit 1794.00.

Declining below the minor support 1760, and the most important thing below 1750, postpones the idea of the rise and puts the price under negative pressure, with targets starting at 1747 and 1737, respectively.

Note: High-impact economic data from the British economy is due today; interest rate decision, the Governor of the Bank of England’s speech and the monetary policy statement issued by the Bank of England and the monetary policy summary, and we may witness high volatility in prices.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations