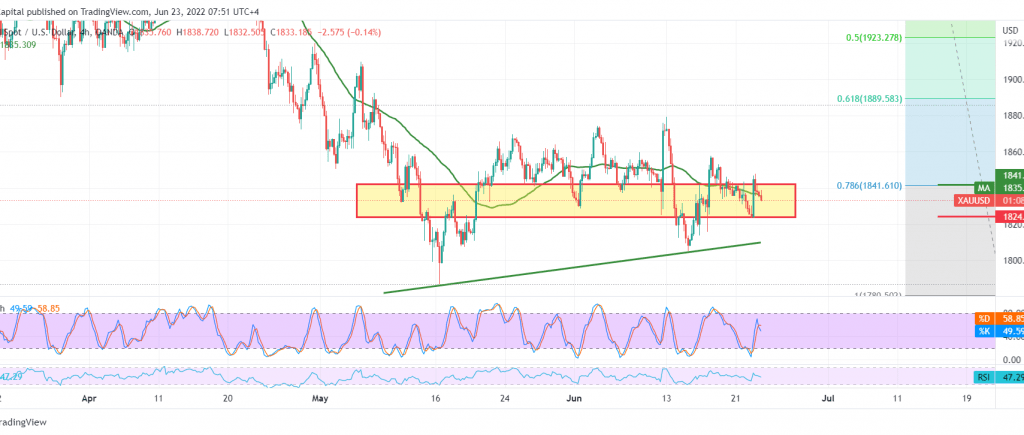

We adhered to intraday neutrality during the last analysis, explaining that we are observing the price behavior of the bullish wave between 1825 and 1842. Furthermore, we indicated that cohesion above 1825 and 1842 are price motivating factors that increase the possibility of touching 1849, so gold recorded its highest price yesterday at 1847.

Technically, trading returned to the sideways range bounded from below above 1825 and from above below 1842, despite the negative pressure coming from the 50-day moving average, accompanied by the clear negative signs on the stochastic indicator.

However, we prefer to monitor the price whip for the second session in a row until the daily trend becomes clearer, waiting for one of the following scenarios.

To activate the bearish scenario, we need to witness a clear and strong break of the 1825 support level, which will initially turn the path into a bearish path, with targets located around 1810 and 1800.

The bullish scenario requires breaking 1846 to target 1858 and 1865.

Note: The testimony of “Jerome Powell” Chairman of the Federal Reserve is due today, and we may witness high volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations