Gold prices achieved the bullish target posted during the previous analysis, at 1808, recording its highest price of 1808 after the US inflation data.

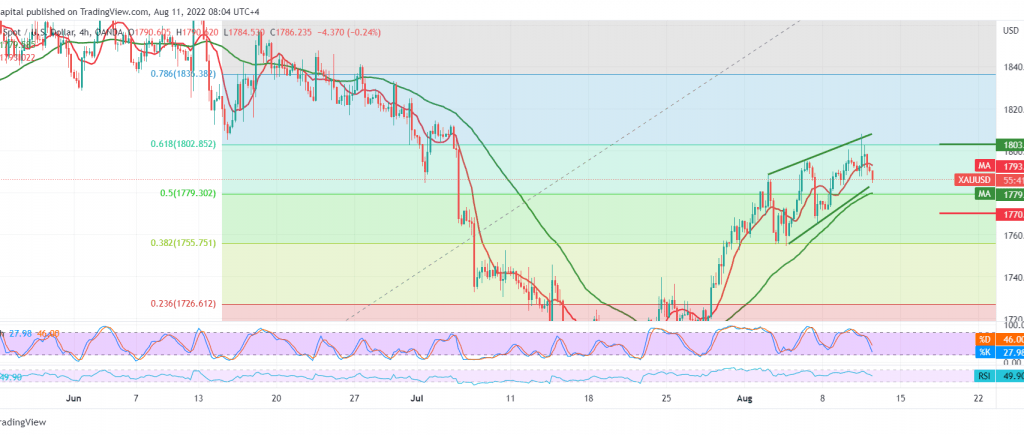

Technically, and by carefully looking at the 4-hour chart, we notice the price stability above the 50-day simple moving average. In addition, we see the precious metal stable above the previously breached resistance, which is now turned to the 1779 support level, 50.0% Fibonacci correction.

We tend to continue rising, targeting 1802 61.80% correction, considering that the stability above the mentioned level can strengthen gold’s gains towards 1815 and 1823, respectively, as long as prices remain stable above 1772.

Note: The obvious negativity on the 14-day momentum indicator may force gold to present some negative moves before resuming its rise again.

Note: The US Producer Price Index is due later in the session; it has a big impact and may cause price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations