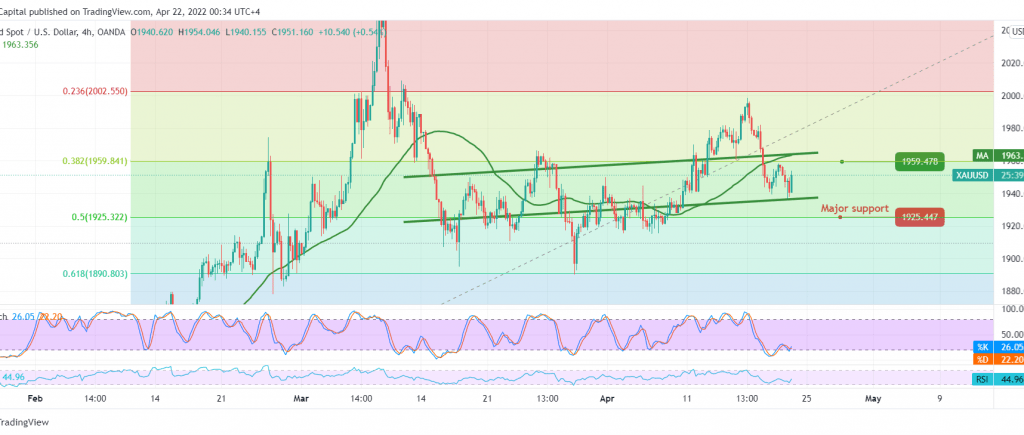

Limited positive attempts were witnessed by gold’s movements yesterday, unable to breach the pivotal resistance level at 1959, which forced the price to touch the 1936 level.

Technically, gold prices got additional support due to the intraday stability above the 1940 support floor. However, with a careful look 240-min chart, we notice that the negativity is still dominating the stochastic indicator, supporting the downside attempts; on the other hand, we see that the 50-day moving average still holds the price from the top.

With the continuation of the technical signals conflict, we prefer to monitor the price behavior of gold for the second consecutive session and wait for the activation of the following pending orders:

Consolidation above 1959, 38.20% Fibonacci, is a catalyst that increases the probability of touching 1970 and 1980.

A breach below 1940 might force gold prices to touch 1925 pivotal support located around 50.0% retracement.

Note: the overall trend is still bullish.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations