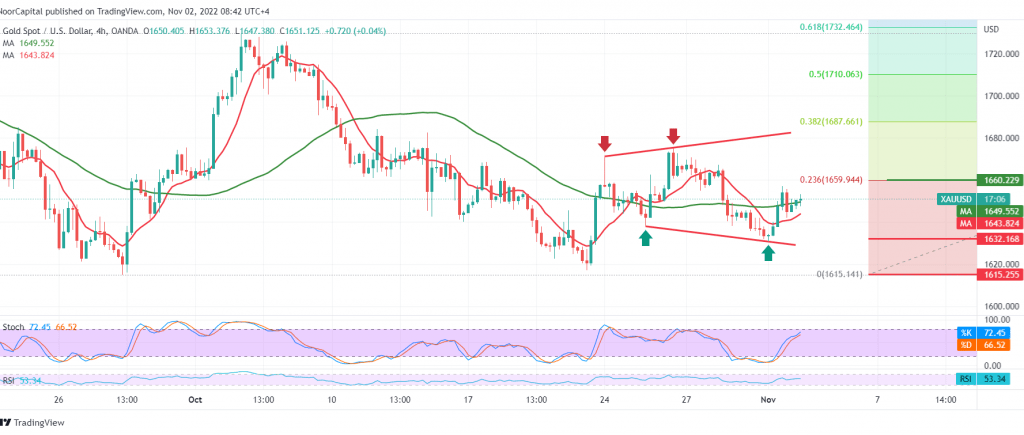

Negative trading continues to dominate gold’s movements within the expected bearish context, to find the price traded negatively as soon as it approached the pivotal resistance level at 1660, which forced it to retest 1630.

Technically, and by looking at the 4-hour chart, we notice the 50-day simple moving average trying to push the price to the upside. On the other hand, we find stochastic losing the bullish momentum and the stability of trading below 1660, 23.60% Fibonacci correction.

We prefer to maintain our negative expectation to visit the official target of 1618 and 1615, respectively, as long as trading remains stable below 1660.

Consolidating above 1660 will immediately stop the bearish scenario, and we will witness a quick and direct recovery in gold prices, with the aim of 1672 and 1687, the next official station.

Note: Investors will monitor the central bank’s statement and Fed Chair Jerome Powell’s press conference. They have

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations