Gold prices managed to touch the target during the previous trading session within the scenario of re-testing the required level, visiting 1901, posting a low of 1894.

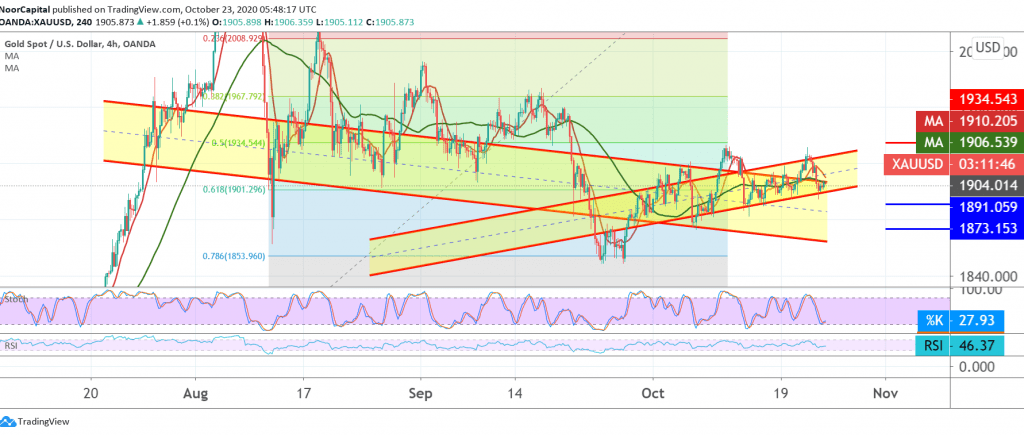

Technically, looking at the 4-hour chart, we find conflicting technical signals, ranging from the negativity of the simple moving averages that continue to negatively pressure prices, to the intraday positivity features of the stochastic indicator.

We will remain neutral in order to obtain a high bargain and maintain yesterday’s profitability rates, so that we are faced with one of the following scenarios:

To confirm the daily bearish trend, we need to break 1901, Fib 61.80% to target 1891 as an initial target, followed by 1885, and it may extend towards 1877.

Activation of long positions depends on the price response to the strong support level 1901, as well as a clear and strong break of the 1922 resistance pushing the price again towards a re-test of 1934, Fib 50.0%.

| S1: 1891.00 | R1: 1922.00 |

| S2: 1877.00 | R2: 1939.00 |

| S3: 1860.00 | R3: 1953.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations