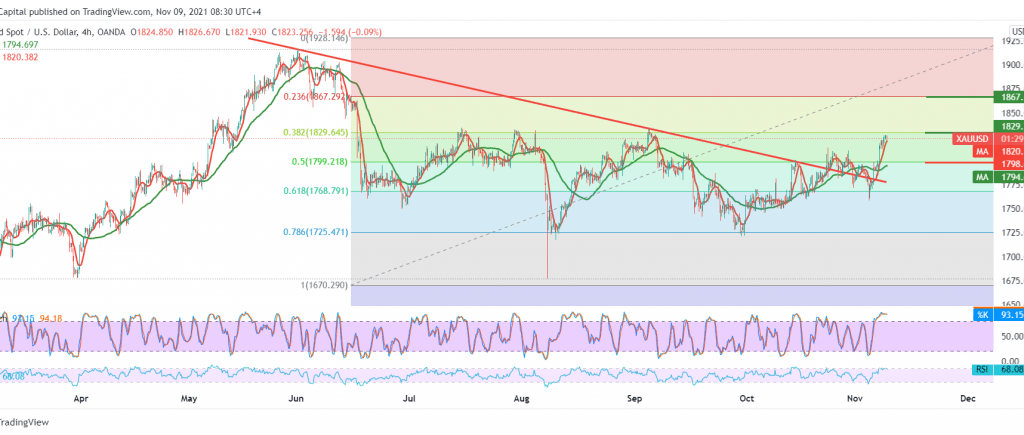

The technical outlook is unchanged, and there was little change in the yellow metal after it succeeded in stabilizing above the psychological barrier of 1800 within an ascending path, approaching a few points from the target published in the previous analysis at the price of 1830, recording its highest level at 1827.

Technically, by looking at the 4-hour chart, we notice that gold obtained a positive stimulus from the 50-day simple moving average. We find the price succeeded in stabilizing positively above the previously breached resistance-into-support 1799, 50.0% Fibonacci correction. Furthermore, we find that the RSI is stable above the mid-line 50, which increases the possibility of rising to visit 1830, Fibonacci correction of 38.20%, the first ascending target. The price should be well monitored around the 1835/1830 resistance level strong supply areas, and its breach opens the door for 1860.

Stochastic is trading around overbought areas and may lose momentum, which may indicate the possibility of a bearish bias before rising again, knowing that if a bearish slope occurs during the session, its target maybe around 1799, and the bearish correction may extend towards 1784.

Note: All scenarios are on the table

| S1: 1814.00 | R1: 1830.00 |

| S2: 1805.00 | R2: 1840.00 |

| S3: 1799.00 | R3: 1848.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations