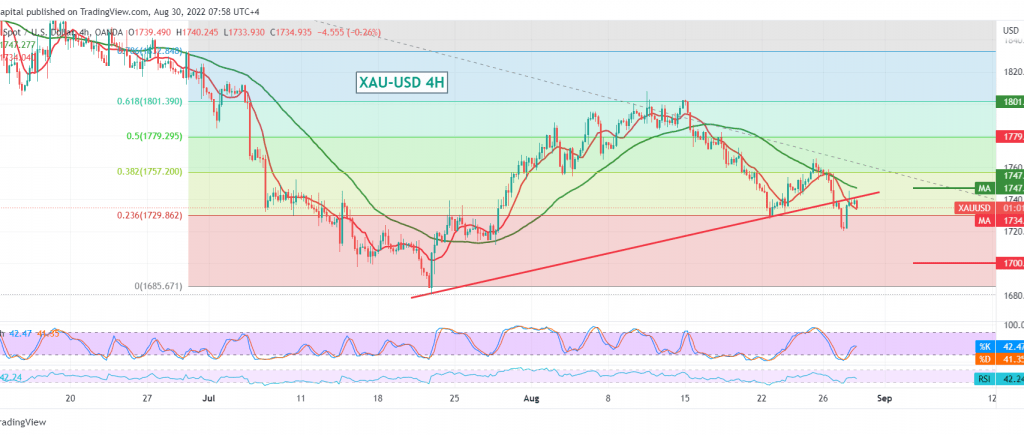

Gold prices found strong resistance around the key supply areas at 1745 published during the previous analysis, explaining that stability and stability below it is a condition for maintaining the general bearish trend on the intraday term, to find gold unable to break it until now.

Technically and carefully considering the 4-hour chart, we find the stochastic is gradually losing momentum, in addition to the continuation of the negative pressure coming from the simple moving averages that support the possibility of a decline.

Confirmation of breaking 1729, and most notably 1726, reinforces our outlook for continuing the bearish trend, targeting 1721 and 1708, respectively, knowing that the official target for the current downside wave is around 1700 as the price is stable below 1745.

Consolidation above 1745 may force gold prices to form a minor bullish correction that aims to retest 1758 before falling again.

Note: The risk level may be high.

Note: The US “Consumer Confidence” index is scheduled to be released later in today’s session, and it has an important impact, and we may witness price fluctuations.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations