Gold’s movements witnessed positive trading at the conclusion of the last week’s trading after it received a strong push to the upside as a result of the US dollar’s decline. We indicated during that trading above 1770 is able to thwart the bearish bias and lead gold to achieve gains whose target around 1781 to record the highest of 1781.

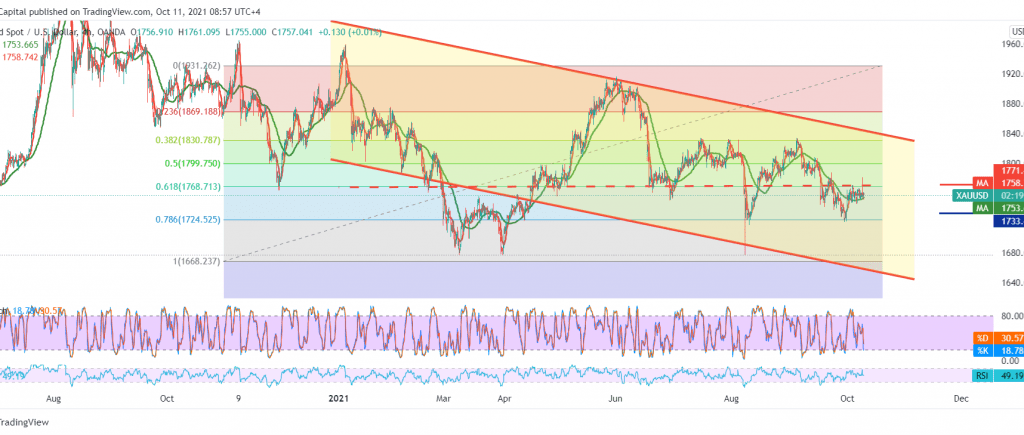

On the technical side today, we find gold prices started to decline as a result of touching the pivotal resistance level published during the previous analysis represented by our bullish target, and with careful consideration of the 4-hour chart, we notice the price stability below 1768 Fibonacci correction 61.80% and most importantly 1770, as we notice negative signs The RSI on the short time frames.

Therefore, the possibility of the bearish trend continuation is still valid, targeting 1750, and breaking it will renew the chances of negative pressure, so we will be waiting for 1744 and 1735.

Rising again above 1770 leads the price to rise again, with an initial target of 1781.

| S1: 1744.00 | R1: 1774.00 |

| S2: 1735.00 | R2: 1792.00 |

| S3: 1714.00 | R3: 1805.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations