Gold prices surged during the previous trading session, successfully breaching the strong resistance level highlighted in the previous report. This breach temporarily halted the downward trend and triggered a rise, with the metal reaching a high of $2665 per ounce, surpassing the initial targets of 2645 and 2657.

Technical Outlook:

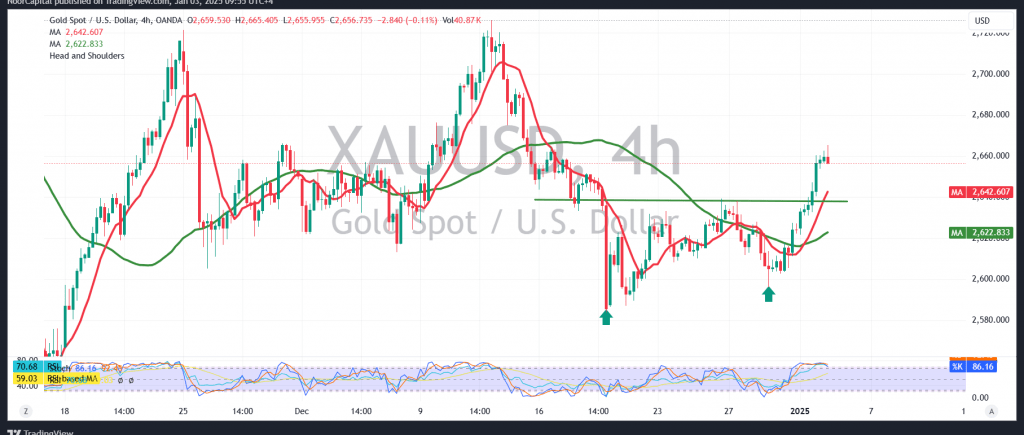

A closer look at the 4-hour chart reveals the formation of a positive crossover in the simple moving averages, signaling further upside potential. Additionally, the emergence of an ascending technical pattern supports the likelihood of continued bullish momentum.

As long as trading remains stable above the previously breached resistance at 2640—and more broadly above 2631—the bullish scenario is favored. The initial target is set at 2675, with a breakout above this level likely to accelerate gains, opening the door to further targets at 2692 and 2700.

Alternative Scenario:

However, a break below 2631 could reintroduce negative pressure, with potential downside targets at 2605 and 2587.

Risk Considerations:

With ongoing geopolitical tensions heightening market uncertainty, volatility remains elevated, and traders should approach with caution as all scenarios remain on the table.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations