Gold (XAU/USD) continues its upward momentum, aligning with our positive outlook from the previous report, approaching the first target of $4641 and currently trading at $4639 at the time of writing.

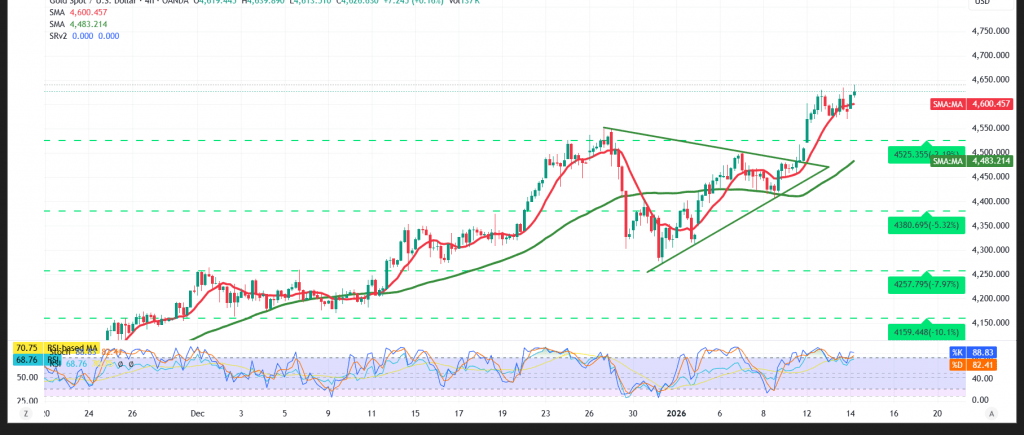

Technical Outlook – 4-Hour Timeframe:

The continued influx of buying capital reflects a clear dominance of buyers within the upward trend, enhancing the potential for further gains in the coming period.

Meanwhile, the Relative Strength Index (RSI) is attempting to alleviate overbought conditions, which could contribute to strengthening the upward momentum.

The price remains stable above the simple moving averages, confirming the continued positive dominance of the main upward trend.

As long as gold maintains daily trading above the support level of $4590, the bullish scenario remains the most likely scenario.

We need:

A clear and sustained break above the $4641 level, which would further strengthen and accelerate the upward trend, paving the way for broader gains towards the next targets of $4660 and $4684.

As a reminder, a confirmed break below the 4590 support level could pave the way for the first downward correction, targeting the 4545 area before a reassessment of the trend.

Note: Today we await high-impact economic data from the US economy (the monthly Producer Price Index and monthly Retail Sales). We may see significant price volatility around the time of the release.

Note: The risk level in trading gold is relatively high and may not be suitable for all investors.

Note: The risk level is high amid ongoing trade and geopolitical tensions, and all scenarios are possible.

Risk Disclaimer: Trading CFDs involves risks, and therefore all scenarios may be plausible. The content above is not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 4590.00 | R1: 4660.00 |

| S2: 4544.00 | R2: 4684.00 |

| S3: 4520.00 | R3: 4730.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations