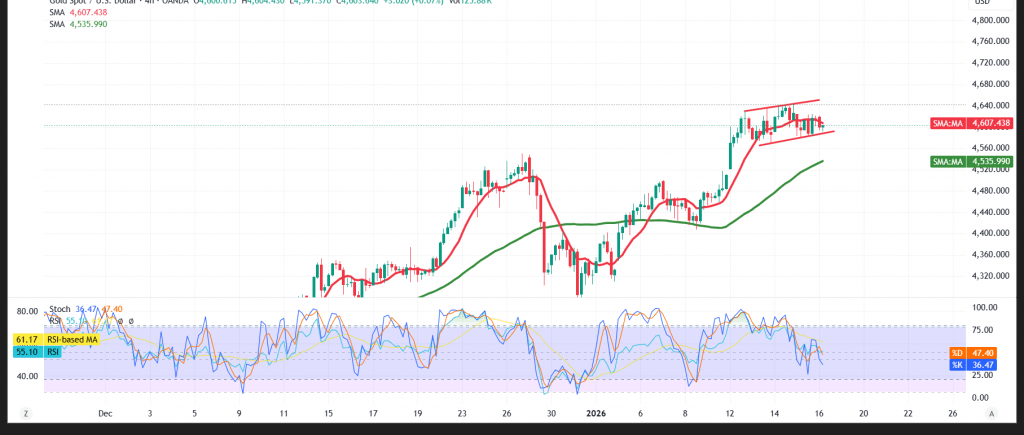

Gold (XAU/USD) has entered a temporary consolidation phase after facing strong selling pressure near its recent peak at $4,642 per ounce. This pause reflects a period of sideways movement as the market awaits clearer directional signals.

Technical Outlook – 4-Hour Chart

The broader trend remains firmly bullish. Simple moving averages continue to provide dynamic support from below, preserving the medium-term upward structure.

That said, the Relative Strength Index (RSI) has started to issue early negative signals, indicating a temporary slowdown in momentum. These signals remain corrective in nature and have not yet altered the dominant bullish trend.

Given the mixed technical backdrop, price action should be closely monitored for confirmation of one of the following scenarios:

- A confirmed break below the $4,580 support level would place gold under renewed downside pressure, with scope for a move toward $4,560, followed by $4,535.

- Conversely, a return to stability above the $4,623 resistance level would signal a resumption of bullish momentum, opening the way toward $4,646 and then $4,667.

Caution:

Gold trading currently carries a relatively high level of risk and may not be suitable for all investors. Ongoing trade and geopolitical tensions continue to elevate uncertainty, keeping all scenarios possible.

Risk Disclaimer: Trading CFDs involves risks, and therefore all scenarios may be plausible. The content above is not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 4580.00 | R1: 4623.00 |

| S2: 4560.00 | R2: 4646.00 |

| S3: 4535.00 | R3: 4667.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations