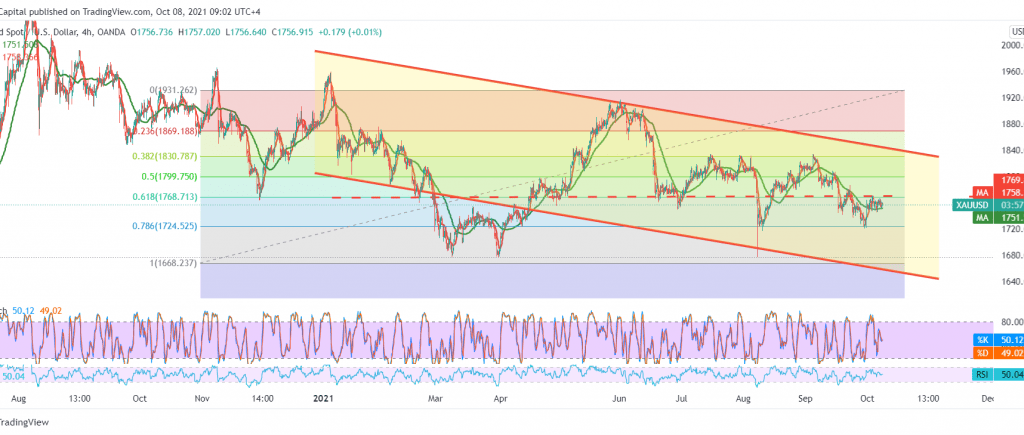

The pivotal resistance at 1768 managed to limit the bullish bias, and the gold price failed to breach it over several consecutive sessions.

Today’s technical aspect indicates fluctuation within a sideways range between the 1768 resistance level, the 61.80% Fibonacci correction, and the 1747 support level. By looking at the chart, we notice the negative signals coming from the stochastic indicator and the stability of trading below the pivotal resistance 1768.

Next, the chances of returning the bearish bias are still intact, knowing that intraday trading below 1752 facilitates the task required to visit 1747 and 1735, respectively, knowing that breaking the last level constitutes a strong negative pressure factor that opens the way for gold to achieve more losses towards 1727/1722.

Activating the suggested bearish scenario depends on the stability of trading below 1768, 61.80% correction, and generally below 1770 because price stability above 1770 negates the retreat and will witness a temporary bullish path whose initial target is 1776 and extends to visit 1781.

Note: the level of risk is high.

| S1: 1747.00 | R1: 1768.00 |

| S2: 1735.00 | R2: 1776.00 |

| S3: 1727.00 | R3: 1787.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations