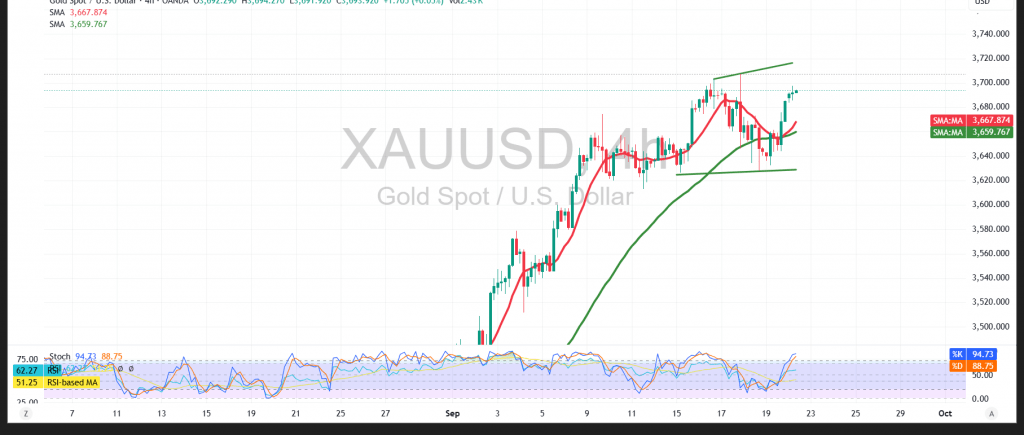

Gold opened the session with an upward bias, recording a daily high of $3,697 per ounce, supported by favorable technical factors.

Technical Outlook:

Price action remains underpinned by stability above the simple moving averages, which continue to act as dynamic support for the uptrend. However, the Relative Strength Index (RSI) has entered overbought territory and is now showing early negative signals, suggesting the potential for limited corrective pullbacks before resuming the broader bullish trend. The 50-period SMA remains a critical support, reinforcing the positive bias.

Probable Scenario:

The uptrend is likely to remain intact as long as prices hold above the key support level of $3,664. A breakout above the recent high of $3,697 would strengthen momentum and open the way for gains towards $3,716 and $3,720. Conversely, a confirmed break below $3,664 could trigger corrective pressure, targeting $3,651 before buyers attempt to regain control.

Warning: Risks are high amid ongoing trade and geopolitical tensions, and all scenarios are possible.

Risk Disclaimer: Trading CFDs involves risks, and therefore all scenarios may be plausible. The content above is not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 3651.00 | R1: 3716.00 |

| S2: 3609.00 | R2: 3740.00 |

| S3: 3585.00 | R3: 3781.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations