Gold prices fulfilled the anticipated negative outlook from the previous report, achieving the initial target at $2634 per ounce and recording a low of $2633.

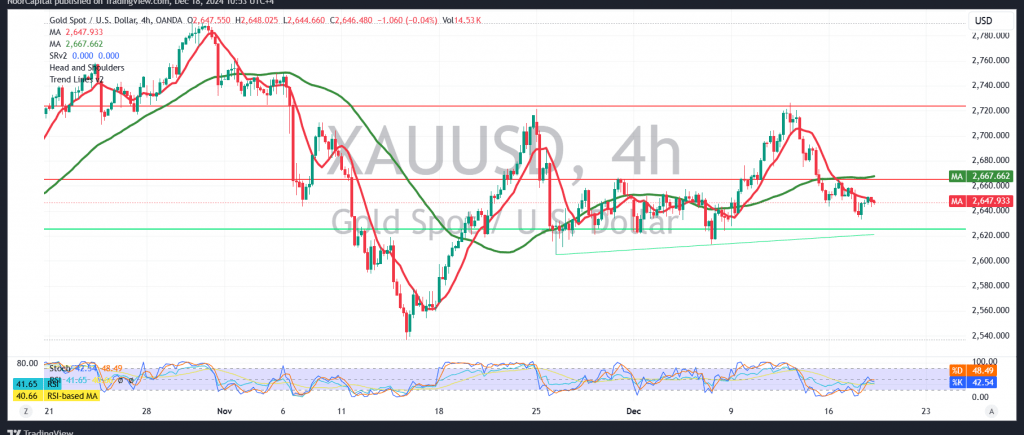

From a technical analysis perspective, a closer examination of the 4-hour chart reveals that the Stochastic indicator is gradually losing upward momentum. Additionally, the price remains stable below the previously broken support level at 2660, reinforcing the bearish sentiment.

As long as trading remains below 2657 and, more importantly, 2660, the bearish trend is favored in the short term. Expected targets are set at 2632 and 2620, with the possibility of further losses extending toward 2615 and 2600.

On the other hand, a consolidation above 2660 would delay the bearish scenario, potentially leading to upward attempts targeting 2670 and 2683. A firm consolidation above 2683 could shift momentum back to the upside, with gold aiming for 2700 and potentially extending gains toward 2720.

Alert: High-impact economic data from the U.S., including the interest rate decision, Federal Reserve Committee statement, economic outlook, and Fed Chair press conference, is expected today. Significant price volatility is likely during the news release.

Warning: The risk level remains elevated amid ongoing geopolitical tensions, and all scenarios remain on the table.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations