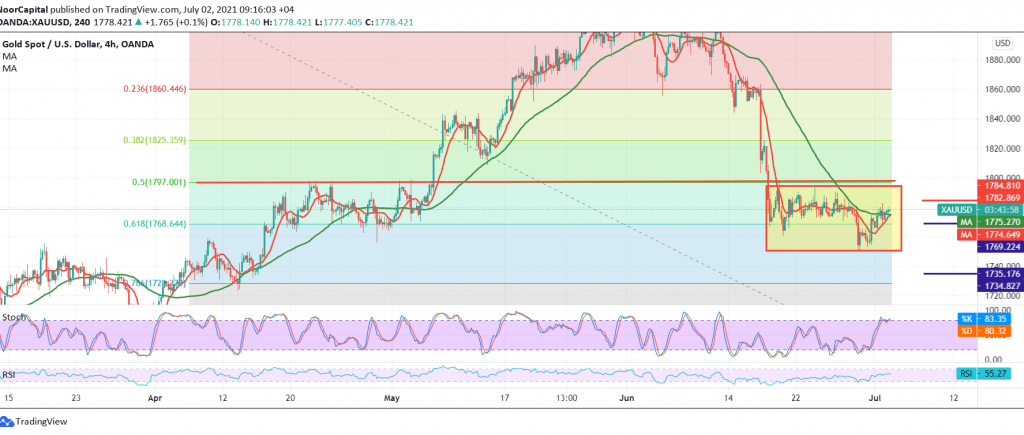

We adhered to intraday neutrality during the previous analysis, due to the exposure of technical signals, to find that gold prices collided with the strong resistance level published during the previous report at 1782, which we mentioned to represent one of the most important trend keys for the current trading levels.

From the angle of technical analysis, gold prices failed to breach 1782 accompanied by the negative pressure coming from the 50-day moving average, which meets around the mentioned level and adds more strength to it, supporting the continuation of the downside wave.

On the other hand, and by moving to the short time frames, we find the RSI trying to provide positive signals accompanied by the stability of the intraday trading above 1767.

We will remain neutral for the second session in a row, until the technical view becomes clearer, waiting one of the following scenarios:

Activating short positions depends on breaking 1768, retracement of 61.80%, to target 1757 and 1750, respectively, taking into account that breaking the latter opens the door to visit the official target of the current downside wave 1734.

Activating long positions requires confirming the breach of 1782/1784, and that is a catalyst that enhances the chances of rising to retest 1794 and 1797, 50.0% Fibonacci correction.

Note: NFP is due today and we may witness high volatility.

| S1: 1767.00 | R1: 1784.00 |

| S2: 1757.00 | R2: 1794.00 |

| S3: 1734.00 | R3: 1800.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations