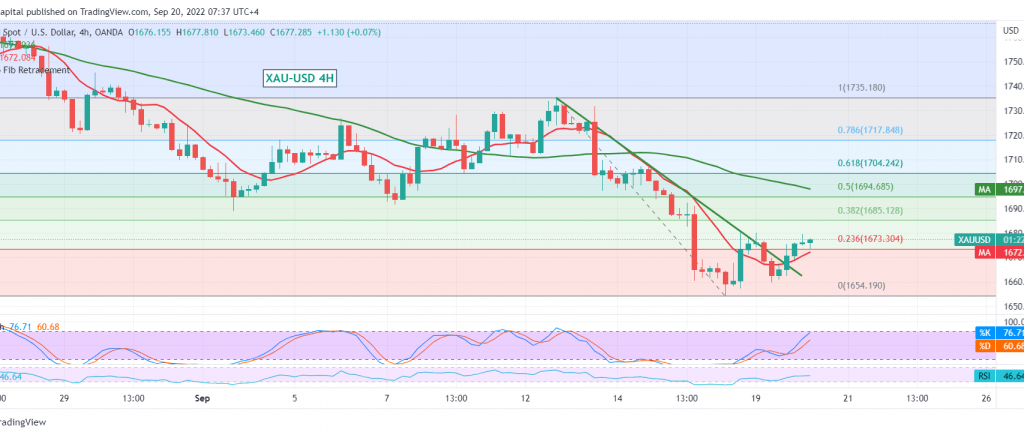

Bullish rebound attempts dominated gold prices yesterday, trying to establish a support level around 1665, recording the highest level of $1680 per ounce during trading last Monday.

On the technical side, the 50-day SMA is still an obstacle to the price, and it is motivated by the clear negative features on stochastic on the 4-hour time frame.

We tend to be negative unless we witness price consolidation above 1684; knowing that the decline below 1663 leads gold prices to complete the descending path, we are waiting for 1650 and 1642 official targets.

Consolidation above 1684, which is a pivotal level for today’s trading, and the price stability above it delays the activation of the proposed scenario, and we are witnessing a temporary recovery targeting 1692/1690, and gains may extend later towards 1703.

Note: The RSI tends to provide positive signals on the 60-minute time frame.

Note: The risk level may be high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations