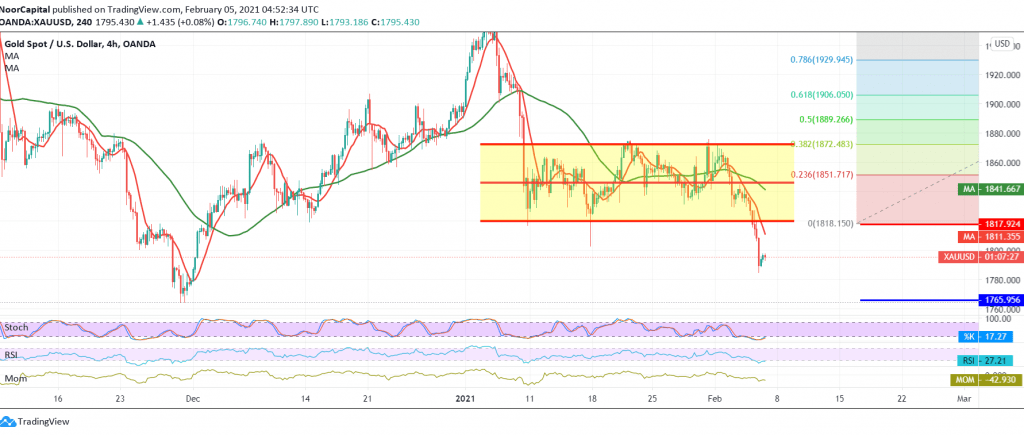

Gold prices incurred heavy losses during the previous trading session within the expected bearish path mentioned in daily analysis, touching the third official leg 1800, recording the lowest price of 1785.

On the technical side today, and with a closer look at the 240-minute chart, we find the 50-day simple moving average pressuring the price from the top, and the RSI indicator continues to defend the downside.

From here and steadily trading below the psychological barrier resistance level 1800 and in general below 1820. We will maintain our negative outlook targeting 1875 and then 1774 a second target, taking into account that trading below the last extends gold’s losses so that we will be waiting for 1763 official stations and may extend targets later Towards 1755.

A reminder that activating the bearish scenario depends on trading remaining below 1820.

| S1: 1774.00 | R1: 1823.00 |

| S2: 1755.00 | R2: 1853.00 |

| S3: 1725.00 | R3: 1872.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations