The key support level highlighted in the previous technical report at $3,190 successfully held, helping to maintain the broader upward trend. Following a rebound from this level, gold prices have resumed their climb, currently trading around $3,228 per ounce at the time of writing.

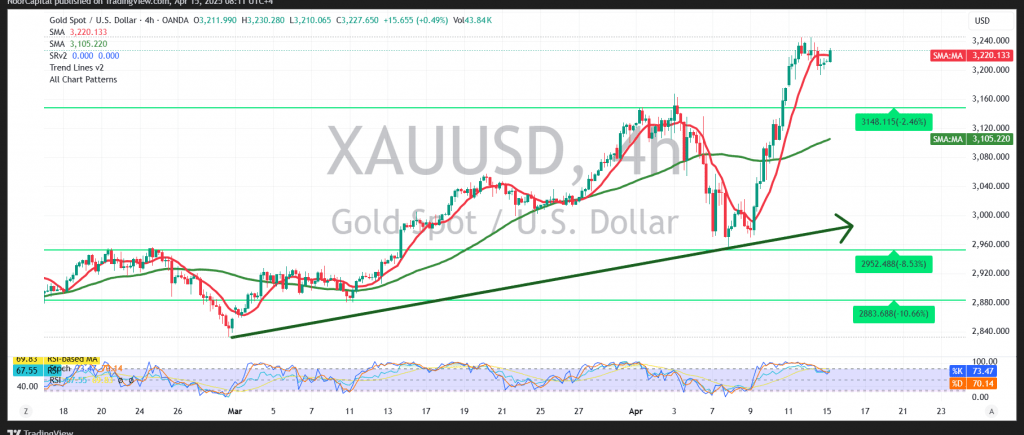

On the 4-hour chart, price action remains aligned with the primary ascending trend line, reflecting continued bullish momentum. Simple moving averages are also providing supportive signals, while the Relative Strength Index (RSI) has turned higher after reaching oversold territory—further reinforcing the bullish outlook.

As long as intraday trading remains stable above the $3,200 support level, the continuation of the prevailing uptrend appears likely. Immediate upside targets are seen at $3,251 and $3,274, with a potential extension toward the $3,300 psychological level.

However, a failure to hold above $3,200 could result in a temporary pullback, with key support levels to monitor at $3,170 and $3,145. A breach of these zones may shift the short-term bias.

Risk Disclaimer: Market risk remains elevated due to persistent global trade tensions and macroeconomic uncertainty. All scenarios remain possible, and traders should manage risk appropriately.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations