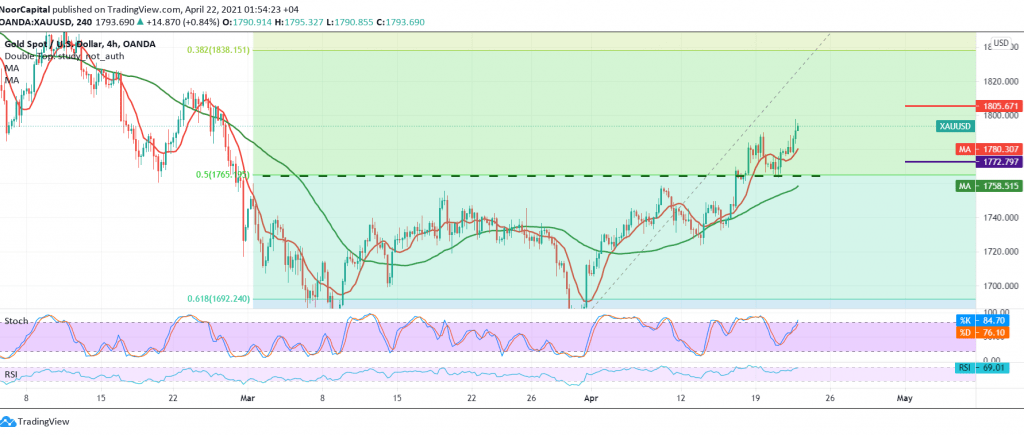

Positive trading dominated gold prices during the previous session, nullifying the negative outlook as we expected and touching the stop-loss order published in the previous analysis at 1780, and to remind us, we indicated during the previous analysis that the confirmation of the breach of the 1780 level is capable of thwarting the bearish scenario and gold regains its health again to target 1790, compensating Part of the selling position losses, as gold reached its highest level in 1797.

On the technical side, today the gold rush and the price stability above 1780 and in general above 1771 supports the rise, supported by positive signs of the RSI. Therefore, the bullish bias is likely today targeting 1804/1805, knowing that the breach of the aforementioned level extends gold’s gains, so the way is directly open towards 1818.

Only from below, the return of trading stability below 1771 puts the price under negative pressure to target 1765, 50.0% correction, and breaking it increases negativity towards 1756 areas.

Note: the level of risk may be high today.

| S1: 1771.00 | R1: 1805.00 |

| S2: 1750.00 | R2: 1818.00 |

| S3: 1737.00 | R3: 1840.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations