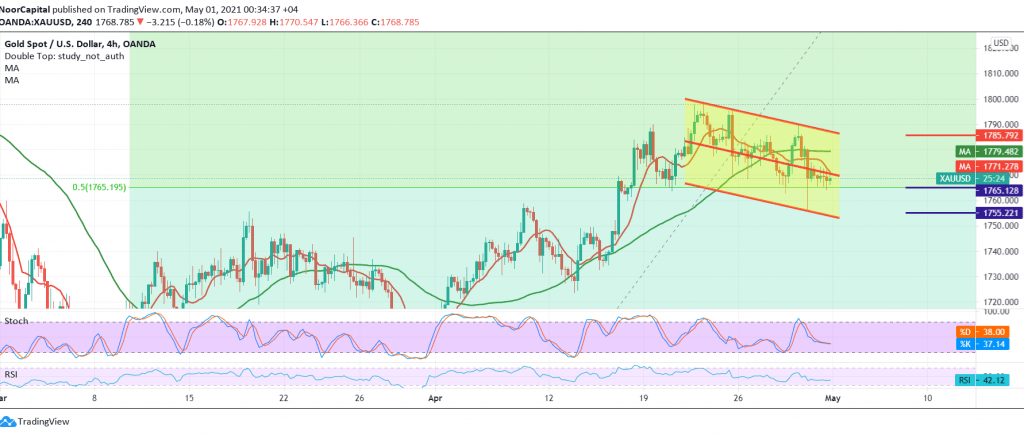

Over several consecutive sessions, gold prices failed to surpass the upside of the pivotal resistance published during last week’s technical reports, located at 1784, which forced the price to pressure on the support level of 1765, and the current moves are witnessing stability around the aforementioned support.

Technically, today, we tend to be negative in our trading, relying on intraday trading below the previously broken minor support converted to the 1772/1773 resistance level, in addition to the negative crossover signals that began to appear on Stochastic.

Therefore, a break of 1765, a 50.0% correction as shown on the chart, leads gold prices to achieve losses targeting 1756, and then 1748 as initial targets that may extend later to 1741.

From the top, the stability of trading below 1780 and the most important of 1784 are basic conditions for the continuation of the decline, knowing that the return of price stability above 1784 will stop the negative outlook and gold will return to trading positively, its targets are around 1792 and 1800.

| S1: 1756.00 | R1: 1784.00 |

| S2: 1748.00 | R2: 1800.00 |

| S3: 1732.00 | R3: 1810.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations