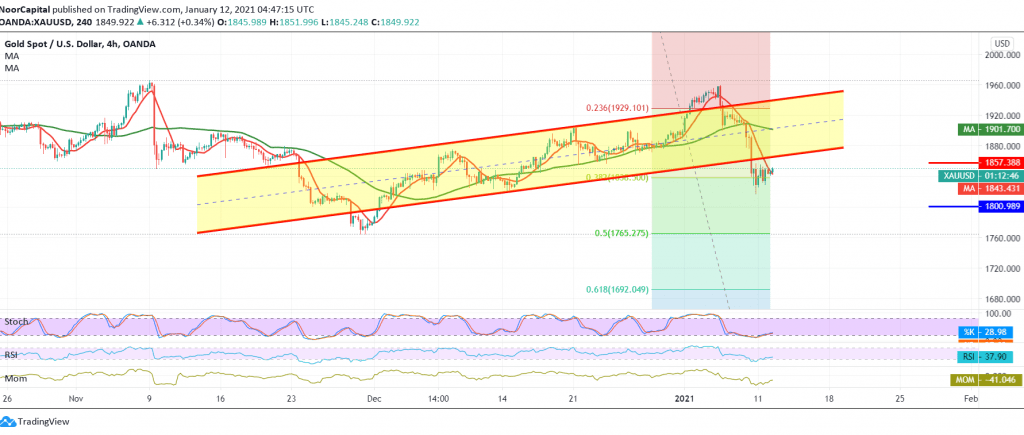

Gold’s movements witnessed a slight bullish tendency during the previous session’s, but there was limited positive trades targeted a re-test of 1865.

On the technical side, we find Stochastic continues to losing bullish momentum gradually, and this comes in conjunction with the negative signs coming from the RSI.

From here, trading steadily below 1856 encourages us to maintain our negative outlook targeting 1837, the first target represented by the 38.20% Fibonacci retracement, then 1823 a next stop.

Confirmation of breaking 1823 puts the price under negative pressure to complete the drop towards 1817, and negative targets may extend to 1800. The bearish scenario requires stability below 1856 and most importantly 1862.

| S1: 1823.00 | R1: 1871.00 |

| S2: 1796.00 | R2: 1892.00 |

| S3: 1775.00 | R3: 1919.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations