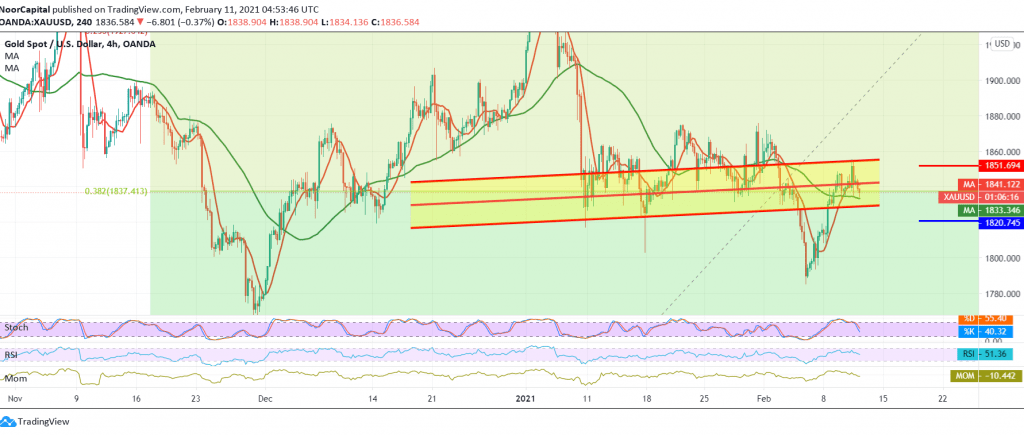

We committed to the intraday neutrality during the previous analysis, indicating that we are waiting to confirm the breach of the resistance level of 1845, to enhance the chances of a bullish move towards our first awaited target of 1851, Posting Highest price during the last session at 1855.

Technically speaking, we find that the price has returned to stability below the pivotal resistance at 1851, in addition to the current attempts to stabilize below the resistance level of 1838, the correction of 38.20.

With a closer look at the chart, we find the Relative Strength Index (RSI) has started to gain bearish momentum on short time frames.

Consequently, we may witness a decline in the coming hours, targeting 1828 first and 1820 afterwards. Crossing over to the upside and rising again above 1851/1855 is able to negate the bearish tendency and lead the price to the bullish path with a preliminary target of 1862 and may extend later towards 1866.

| S1: 1828.00 | R1: 1851.00 |

| S2: 1820.00 | R2: 1862.00 |

| S3: 1807.00 | R3: 1870.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations