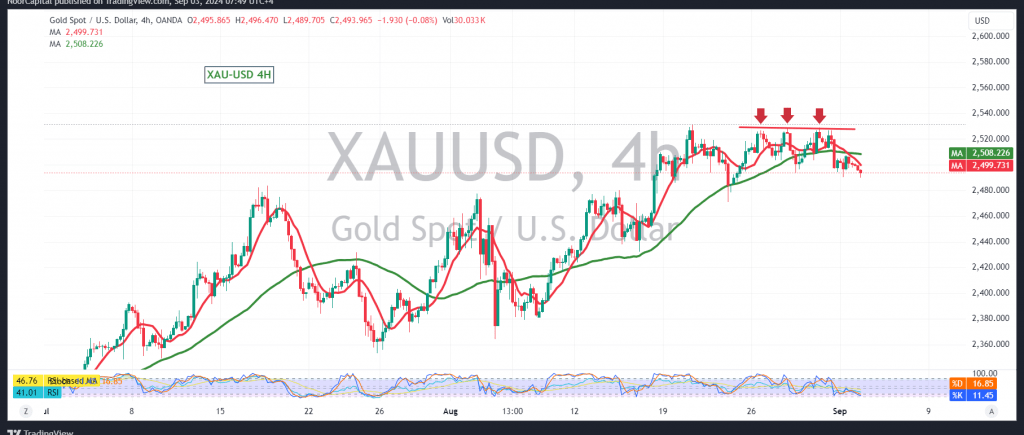

Gold prices experienced a mild downward trend during the previous trading session, attempting to stabilize above the psychological resistance level of 2500, but ultimately closed the day below this threshold.

From a technical standpoint, the price is under selling pressure, largely due to its position below the 50-day simple moving average. Additionally, the Stochastic indicator on the 240-minute chart is showing clear negative signals.

Given this setup, we may see continued downward movement, with an initial target of 2486. A break below this level could accelerate gold’s decline, opening the path towards 2470 and possibly 2465.

On the upside, if the price regains stability above the 2506 resistance level, we could see a short-term rebound, targeting 2513 and 2520, with potential gains extending to 2540.

Warning: The risk level is high, especially amid ongoing geopolitical tensions, which could lead to significant price volatility.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations