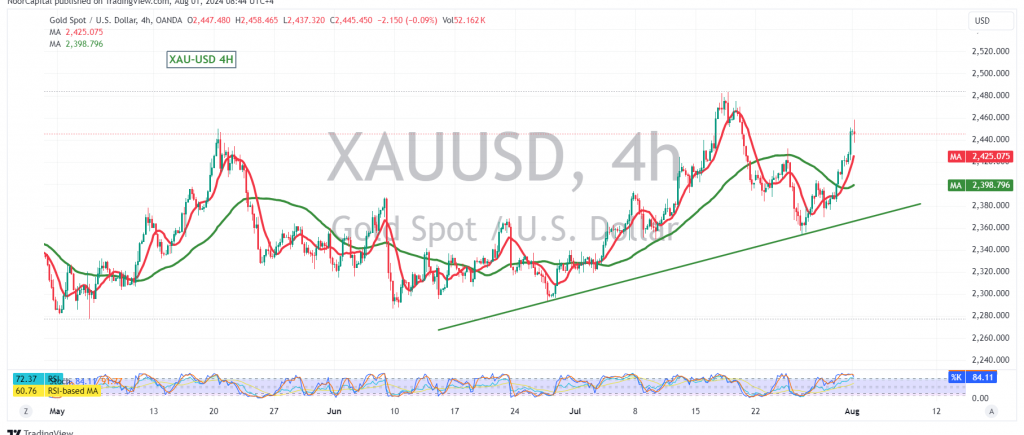

Gold prices saw notable gains in the previous trading session. Previously, we maintained a neutral stance due to conflicting technical signals, noting that a break above 2394 could trigger an upward trend towards targets of 2410 and 2420, with potential further gains extending to 2437. The price has now reached a high of 2458.

From a technical analysis perspective, the simple moving averages are now supporting the price from below, reinforcing the continuation of the upward trend. The price has successfully breached the resistance levels at 2410 and 2430, which have now turned into support levels due to the role reversal concept.

We may see attempts to continue the upward movement, especially if the price holds above 2458, which would strengthen and accelerate the uptrend towards the next targets of 2467 and 2490.

Conversely, if the hourly candle closes below 2410, this could temporarily halt the upward movement and lead to a bearish correction, targeting a retest of 2393 and 2380.

Caution: The Stochastic indicator is showing signs of trying to overcome current negative pressure, which may lead to some fluctuations before the direction becomes clear.

Caution: The risk level may be high. Additionally, today we anticipate significant economic data releases, including the Bank of England’s interest rate decision, monetary policy summary, Monetary Policy Committee vote on interest rates, and a speech by the Bank of England Governor. In the US, we are expecting data on unemployment benefits and manufacturing PMI. These events could result in high price volatility.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations