We adhered to intraday neutrality during the last report due to the conflicting technical signals and the lack of clarity of direction, explaining if the breach of the 1832 resistance level is confirmed, this is a catalyst factor that may enhance the chances of the price rising to visit 1840, so that gold is satisfied with recording the high of 1836, from which it quickly returned to the downside.

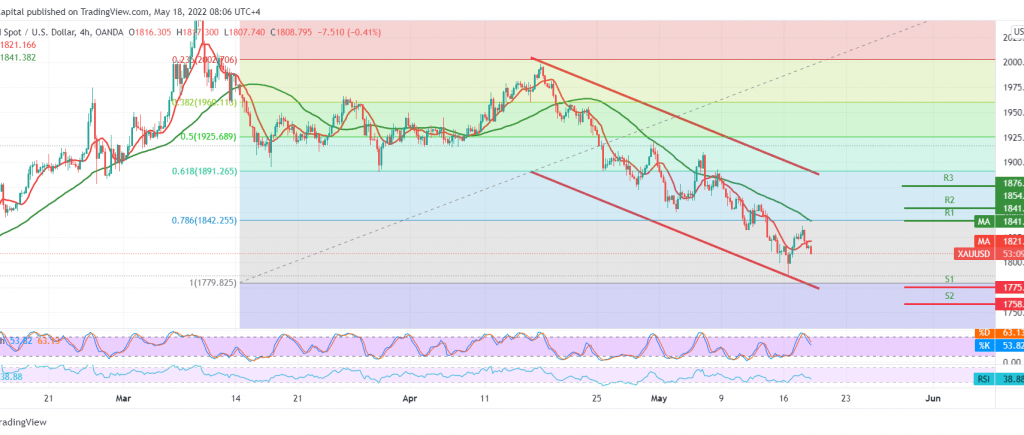

On the technical side, the current moves of gold are witnessing stability around its lowest level during the early trading of the current session 1807. With careful consideration of the 4-hour chart, we notice the continuation of the movement below the 50-day simple moving average and the stability of the RSI below the mid-line 50.

From here, and with the return of the stability of intraday trading below 1830, the bearish scenario remains valid and effective, complementing our bearish targets to visit 1798/1800, taking into consideration that the decline below the mentioned level extends gold losses towards 1788 and 1785 respectively, initial targets that may extend later to visit 1772.

Activating the above suggested bearish scenario depends mainly on stability below 1827 and generally below 1830, knowing that skipping again above 1830 leads gold to visit 1842/1840.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations