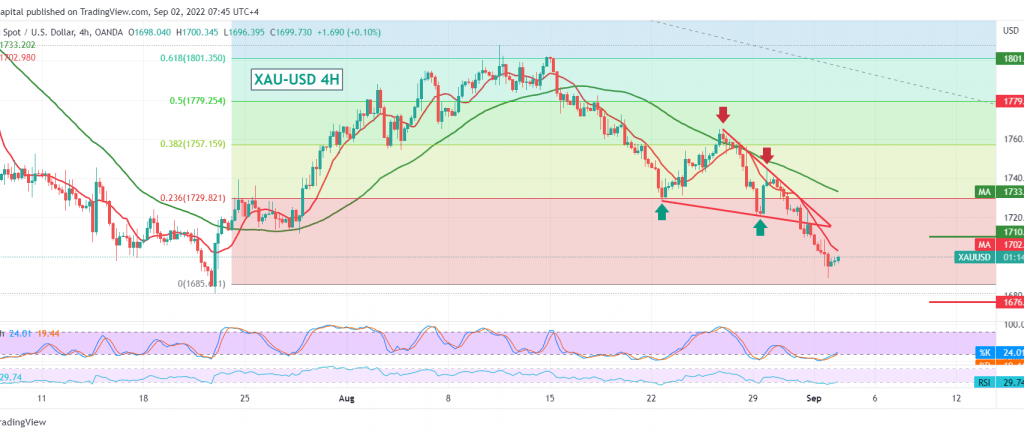

Substantial losses dominated gold prices during the previous trading session, within the expected negative outlook, touching the first target that is required to be achieved at 1695, and it is approaching by a few points from the second target 1686, to be satisfied with recording $1688 per ounce.

Technically, by looking at the 240-minute chart, gold confirmed the breach of 1729 and then 1710 accompanied by the negative pressure of the simple moving average that is pressing the price from above. The continuation of the decline supports the stability of the RSI below the 50 mid-line on the short time frames.

Therefore, the bearish trend remains the most likely, targeting 1686, and breaking it will motivate the price to offer more concessions. We see an ounce of gold around 1676 initially, and losses may extend later towards 1665.

From above, consolidation and stability above 1729, the previously broken support-into-resistance, capable of postponing the above-suggested scenario, and witnessing attempts for a temporary recovery to retest 1733 and 1745.

Note: The US NFP, unemployment rate data and average wages are due for release today in the USA, and they have a big impact, and we may see price fluctuations; all scenarios are on the table.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations