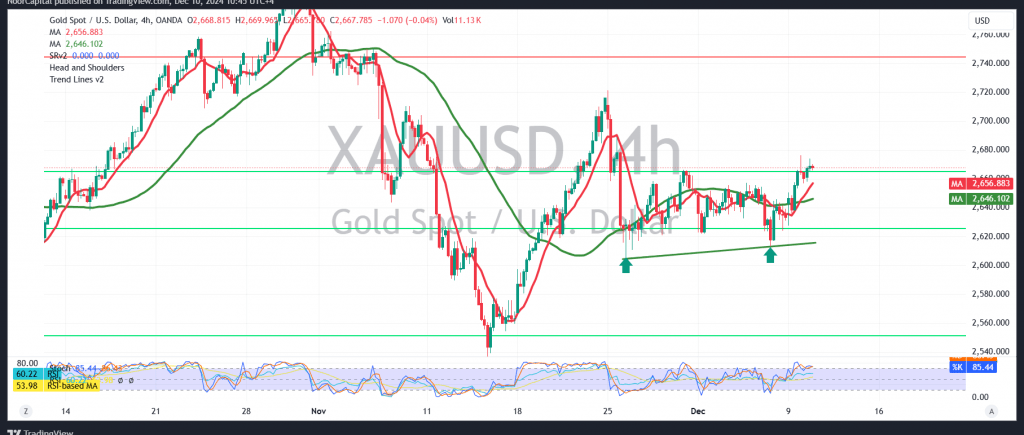

Gold prices showed a neutral stance in the previous analysis due to conflicting technical signals, with an emphasis that a clear breach of the pivotal resistance at 2655 would serve as a catalyst for a bullish trend, targeting 2665 and 2671, eventually recording a peak at $2676 per ounce.

Today, the technical outlook suggests the possibility of extending the upward momentum initiated in the previous session. Analyzing the intraday chart reveals that the simple moving averages have shifted positively, providing further bullish support, while the Stochastic indicator hints at overcoming recent negativity.

With trading stable above the support level of 2645, the bullish scenario remains favored, targeting 2687 initially, with potential gains extending toward the official station of 2700.

A break below 2645, however, would reintroduce bearish pressure, with initial downside targets at 2610.

Warning: The risks remain high and may not align with the expected return.

Warning: The risk level is elevated amid ongoing geopolitical tensions, and all scenarios are possible.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations