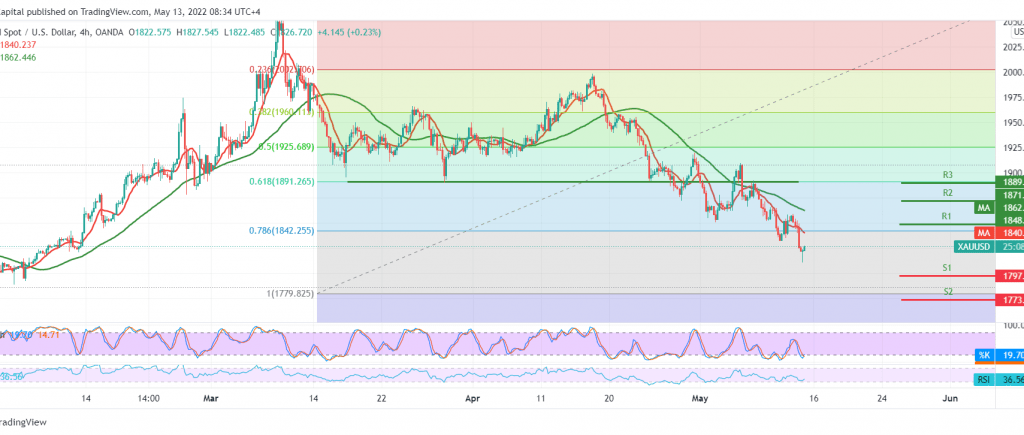

Gold prices declined significantly at the end of the previous trading session, within the expected bearish path, touching the official target at 1810, recording its lowest level at 1810.

Technically, and carefully considering the 4-hour chart, we notice that the price settled intraday below 1835, and most importantly below 1852, with the continuation of the negative pressure of the 50-day simple moving average.

Therefore, the bearish scenario remains the most preferred during the day, knowing that the decline below 1810 may force gold prices to visit 1800/1804. The price behavior must be monitored well around these levels because breaking it extends the current bearish trend to be waiting for 1780.

Activating the proposed scenario requires the stability of intraday trading below 1835, and, most importantly 1852.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations