Gold prices experienced mixed performance during the previous trading session, with bullish momentum fading and the market opening today with a bearish bias.

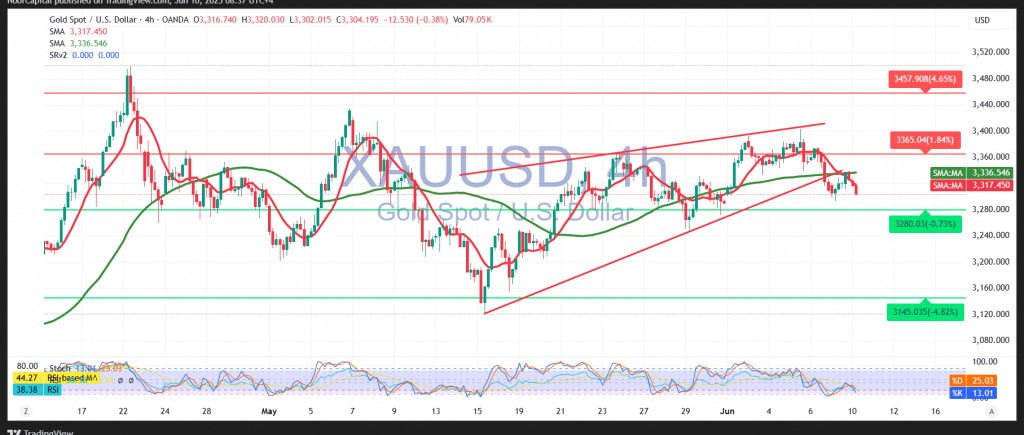

From a technical standpoint, a closer analysis of the 4-hour chart shows that gold failed to break through the critical resistance level at $3,325. The simple moving averages are now beginning to apply downward pressure, while the Relative Strength Index (RSI) is generating clear negative signals. This bearish sentiment is further supported by the price’s break below the ascending price channel.

Given these signals, we maintain a cautiously bearish outlook in the short term, targeting $3,286 and $3,280 as initial downside levels. A confirmed break below $3,280 could open the door for a deeper corrective decline, with the next support level around $3,265.

On the other hand, a successful breach of the $3,325 resistance—followed by a move above $3,331—would invalidate the current bearish bias, setting the stage for a potential short-term recovery toward $3,357.

Warning: Market conditions remain volatile amid ongoing trade tensions. Risk is elevated, and traders should prepare for rapid price fluctuations in either direction.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations