Gold prices incurred noticeable losses during the previous trading session within the expected bearish context, touching the second official target station in the last analysis, at 1753, and recording the lowest at 1750.

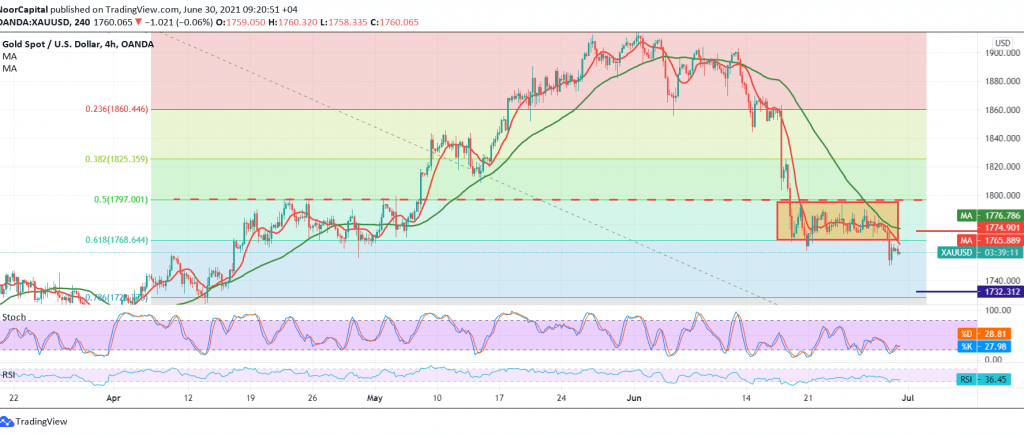

Today’s technical vision indicates the possibility of continuing the decline, relying on confirming the breach of 1768 level, 61.80% Fibonacci correction, in addition to the continuation of the negative pressure coming from the simple moving averages that support the general bearish price curve.

Therefore, we maintain our negative outlook, completing towards 1745, and then 1735/1734, the official target for the current downside wave, which was measured from 1719 level to 1676 low.

From above, the stability of intraday trading above 1774, and most notably 1780, will postpone the chances of a decline, and we may witness a slight bullish slope that aims to retest 1791.

| S1: 1768.00 | R1: 1785.00 |

| S2: 1761.00 | R2: 1791.00 |

| S3: 1753.00 | R3: 1797.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations