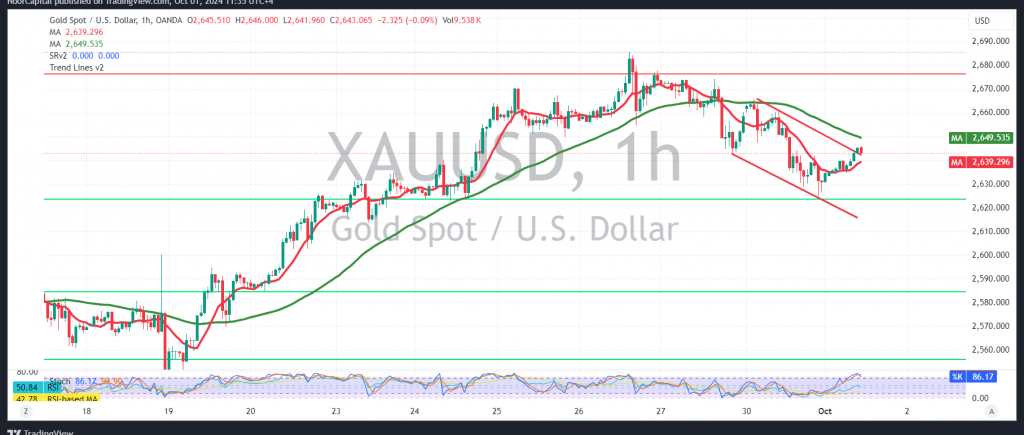

Gold prices declined during the previous trading session after failing to maintain stability above the 2645 support level, moving toward the first official target of $2624 per ounce.

Today’s technical analysis indicates a likelihood of continuing the corrective decline. A closer look at the 4-hour chart reveals that the simple moving averages are exerting downward pressure on the price, coinciding with clear negative signals from the 14-day momentum indicator.

With intraday trading remaining below the 2665 resistance level, the downward trend is expected to remain valid, targeting 2622. A breach below this level would accelerate the decline, opening the way toward the next target at 2605.

On the upside, a break above and consolidation beyond 2665 would lead the price to regain its upward trajectory, targeting 2685 and potentially 2700.

Warning: The general directional movement is still upward.

Warning: The level of risk may be high.

Warning: Today, we expect high-impact economic data from the US economy, specifically the “Job Vacancies and Labor Turnover” report, which could lead to significant price volatility.

Warning: The risk level remains high amid ongoing geopolitical tensions, and all scenarios remain possible.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations