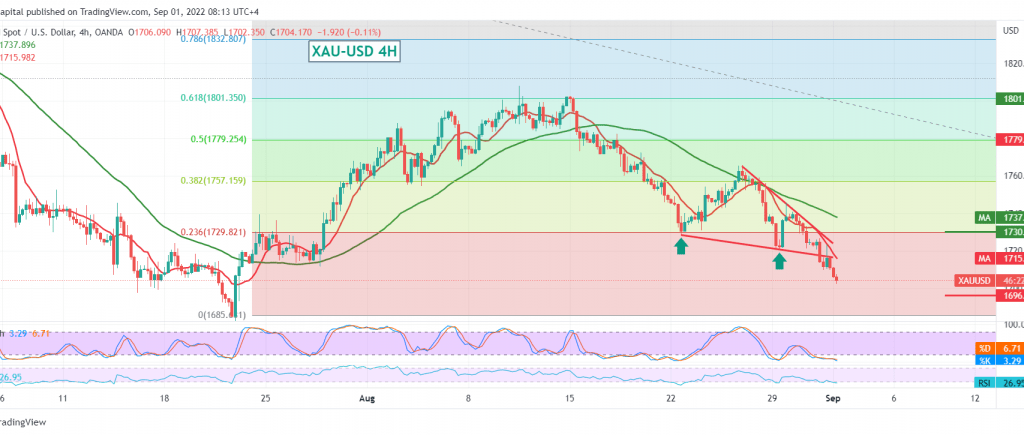

Gold prices achieved noticeable losses within the expected negative outlook, in which we relied on the stability of trading below the broken support level 1729, heading to touch the bearish targets 1716 and 1708, and approaching by a few points at the official station 1700, recording its lowest price during the morning trading session of the current session at 1702.

Technically, and carefully considering the 4-hour chart, we find that the simple moving averages continue their negative pressure on the price from the top, supporting the occurrence of more decline, which coincides with the stability of the 14-day momentum indicator below its mid-line.

Therefore, the bearish scenario remains the most likely, targeting 1695 first targets, then 1686 next stations, knowing that breaking it increases the strength of the current descending wave to make the door open to visit 1676.

Activating the suggested scenario requires daily trading to remain below the previously broken support, which is now turned into a resistance level at 1929, 23.60% Fibonacci correction.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations