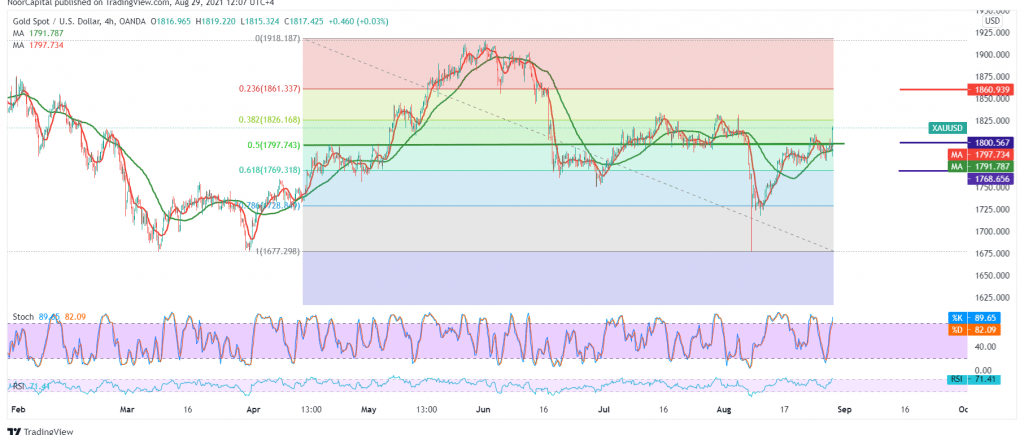

The prices of the yellow metal jumped on Friday, supported by the statements of the Federal Reserve Chairman last Friday, to be able to breach the resistance level of 1799, heading towards touching the previous target mentioned in the previous report, at 1820.

Today’s negative view indicates the possibility of resuming the rise, with the positive motive coming from the 50-day moving average. Thus, we tend to be positive, but with caution, knowing that confirming the breach of 1820 is extending gold’s gains so that the way is directly open to visit 1825, 38.20% correction and 1829/1830, and gains may extend later towards 1840.

Intraday stability returns below resistance into support 1799, Fib 50.%, which will stop the current rise, and we may witness negative trades targeting 1774.

Note: Stochastic is trading around overbought areas in addition to the RSI sending warning signals. Note: the risk level may be high today.

| S1: 1794.00 | R1: 1829.00 |

| S2: 1771.00 | R2: 1841.00 |

| S3: 1760.00 | R3: 1861.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations