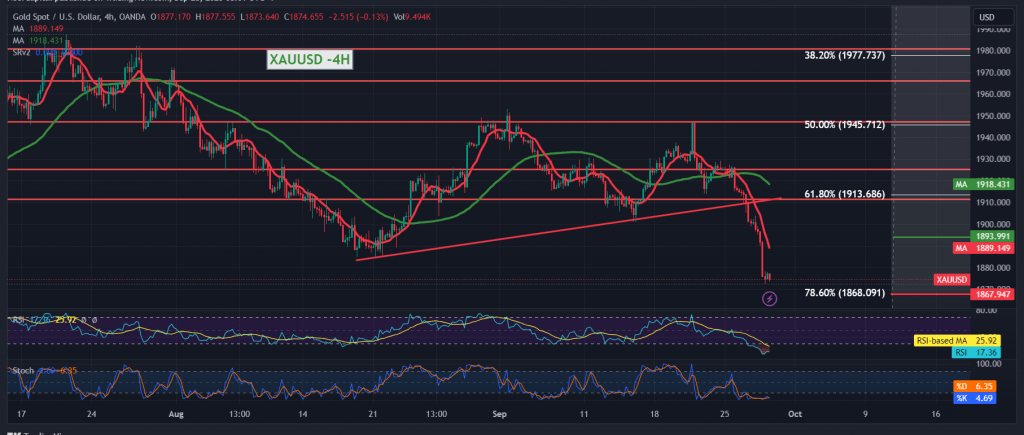

A sharp decline in gold prices within the expected downward path, in which we relied on breaking 1913, with the price heading to achieve the official target required to be touched during the previous trading session at 1880, recording its lowest level at $1873 per ounce.

Today’s technical aspect indicates the possibility of resuming the downward trend after the price fails to maintain trading above the 1894 level, accompanied by the negative intersection of the simple moving averages that continue to support the daily bearish price curve.

From here, with the stability of intraday trading below 1894, and in general below the main support that was previously broken and converted to the 1913 level, Fibonacci retracement 61.80%, the downward trend remains the most preferable, noting that breaking 1873 facilitates the task required to visit 1868, and the price must be carefully monitored around 1868 due to its importance, and breaking it will extend Losses are expected at 1864 and 1853, respectively.

As a reminder, the price’s consolidation above 1894 with the closing of at least an hour candle will lead the price quickly and directly to retest the 1913 61.80% correction before determining the next price destination.

Note: Today we are awaiting high-impact economic data issued by the American economy, the final reading of the gross domestic product and Federal Reserve Chairman Jerome Powell speech, and we may witness high price volatility.”

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations