The negative pressure continues to dominate the yellow metal prices, gradually approaching the awaited second target 1844, to record its high during the previous session’s trading of 1851.

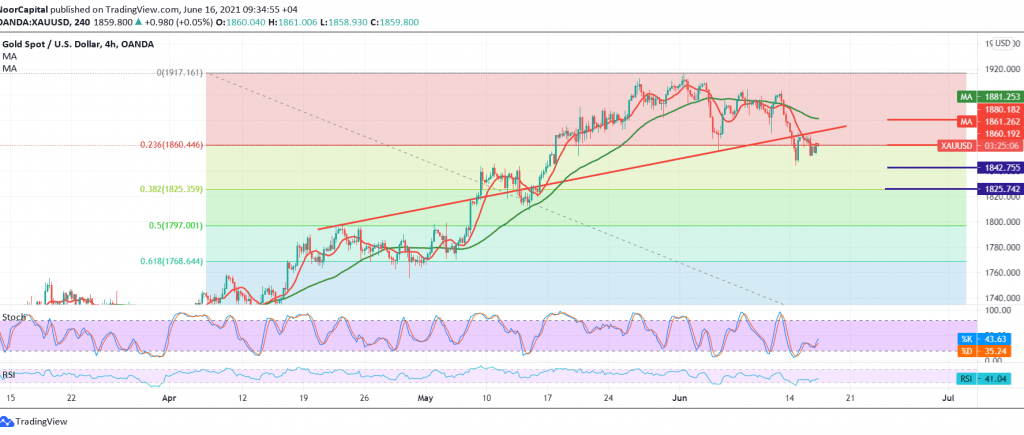

Technical view indicates the possibility of continuing the bearish corrective slope based on the clear negative crossover signs on stochastic, coinciding with gold’s continued negative pressure from the 50-day moving average, which meets around the previously broken support 1880 and adds more strength to it.

Therefore, we will maintain our negative outlook, targeting 1841, and we should be aware that the breach of the mentioned level increases and accelerates the strength of the bearish corrective tendency, so that we will be waiting for the third official target 1838, and after that 1825 is a 38.20% correction as a next station.

Activating the bearish scenario depends on the stability of trading below the previously broken support, which is now converted into a resistance level according to the concept of trading roles at the price of 1868 and most importantly 1880.

Trading above 1885 will immediately negate the view of a decline and we may witness a bullish bias with an initial target of 1896.

| S1: 1850.00 | R1: 1868.00 |

| S2: 1841.00 | R2: 1877.00 |

| S3: 1832.00 | R3: 1886.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations