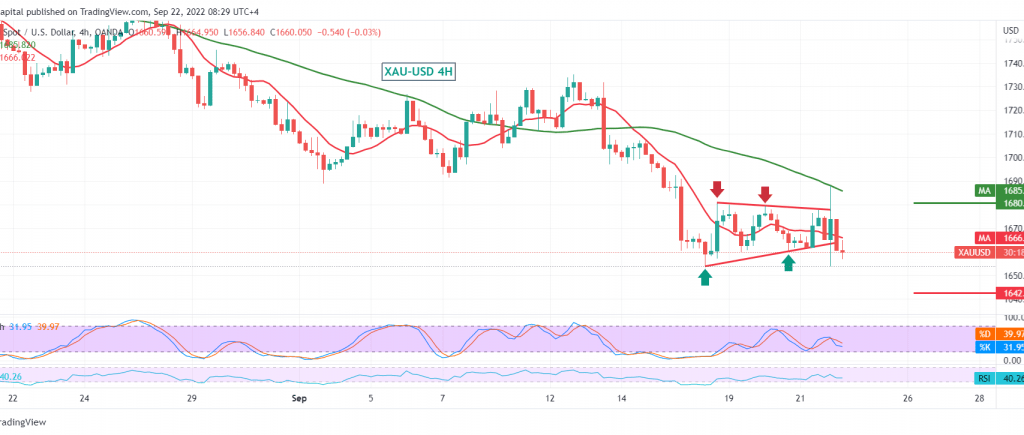

Gold prices reached the first bearish target at 1656 and approached by a few points at the next target, 1650, recording its lowest level of $ 1653 per ounce.

Prices showed mixed trading after touching 1653, resuming the bullish intraday bounce to retest the 1686 resistance level and fail to maintain the intraday gains. Gold is now trading below 1680 resistance, accompanied by the continuation of the negative pressure from the simple moving averages, in addition to the negative signs of the RSI.

Therefore, the possibility of continuing the decline is still valid and effective, provided that we witness a break of 1653, which increases and accelerates the strength of the daily bearish trend, opening the door to visiting 1646 and 1632 waiting stations.

Activating the suggested bearish scenario depends on the stability of the daily trading below 1681/1680. However, the consolidation above it will immediately stop the suggested trend, and gold will start to recover temporarily to visit 1694 and 1702.

Note: The risk level may be high.

Note: We are awaiting high-impact data from the UK “British interest rate decision, monetary policy summary, and MPC votes,” and we may see price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations