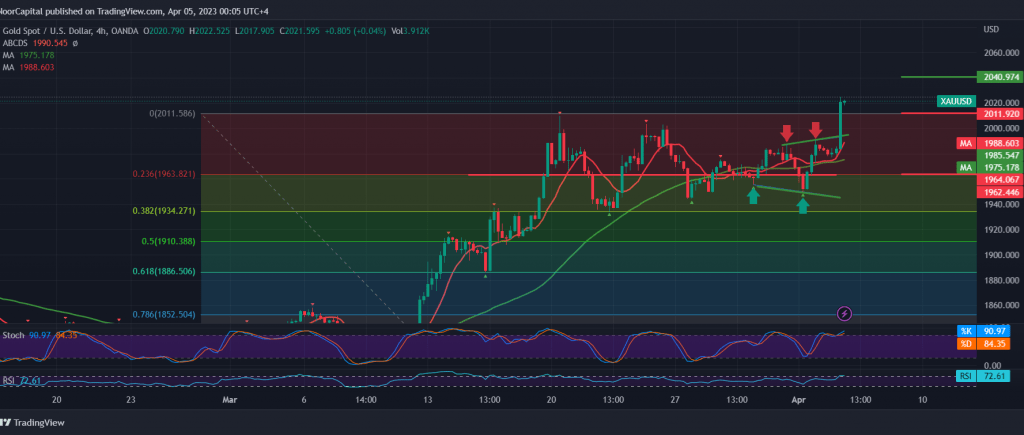

Gold prices continue to achieve substantial against USD, in line with the bullish trend, as we expected during the previous trading session, touching the second official stop at $2025 per ounce.

Technically, and with a close look at the 240-minute chart, we find that the relative strength index continues to defend the bullish directional movement, stimulated by the positive motive of the 50-day simple moving average, in addition to the price’s success in stabilizing intraday above 2009.

Therefore, we maintain our positive expectation, continuing towards the third target, 2040, an official expected station, and the price behavior must be well monitored around this level due to its importance to the general trend in the medium term and the breach of 2040 may lead gold prices to complete towards 2055 unless we witness any trading below 1990, and in general we are continuing Suggesting the overall bullish trend as long as trading is stable above the critical support 1960.

Note: Stochastic is oversold, and we may witness some fluctuation until we get the required official trend.

Note: the risk level is high

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations