Gold prices continue to surge within the framework of a strong upward trend, as anticipated in previous reports. The metal has successfully reached the official target at $3,274 and recorded a new session high of $3,286 per ounce during early morning trading.

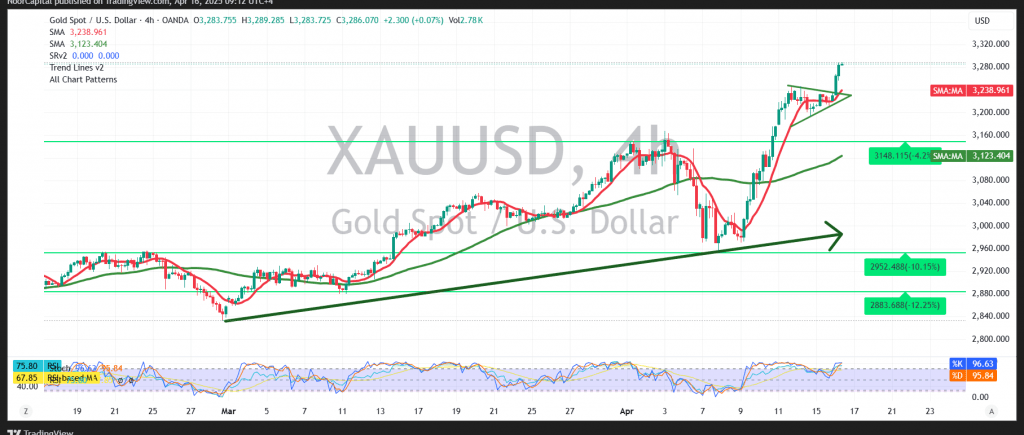

On the 4-hour chart, price action remains firmly aligned with the main ascending trend line. The bullish structure is supported by upward-sloping simple moving averages, which continue to act as dynamic support. Additionally, the Relative Strength Index (RSI) maintains its bullish posture, despite lingering in overbought territory—further reinforcing the ongoing upside momentum.

As long as intraday trading remains stable above the $3,234 support level, the bullish trend is expected to continue. The next upside target lies at $3,310, with further gains potentially extending toward the $3,336 resistance level.

However, a break below $3,234 could lead to a temporary corrective move, with support seen at $3,184, where buyers may look to re-enter the market.

Key Event Risk Today:

Significant economic events could influence price action, including:

- United States: Retail Sales data and a speech by a Federal Reserve Governor

- Canada: Bank of Canada interest rate decision, monetary policy report, and press conference by the BoC Governor

These events may trigger sharp volatility across gold and related markets.

Risk Disclaimer: The current environment is characterized by heightened uncertainty due to global trade tensions and central bank policy updates. Traders should manage risk prudently, as all scenarios remain on the table.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations