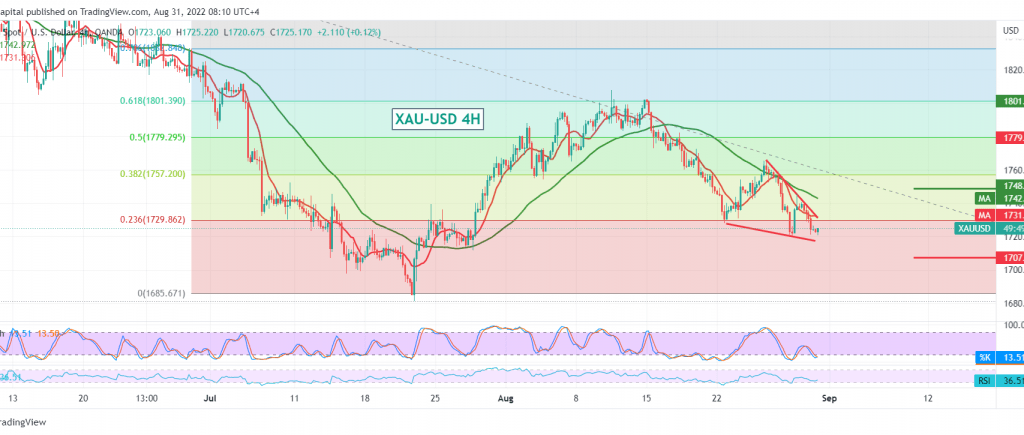

Gold price movements witnessed negative trading yesterday, within the negative outlook, as we expected, based on confirming the breach of the support level of 1729, touching the first target of 1721, to record the lowest level of $1720 per ounce.

On the technical side, price stability below the 1729 Fibonacci correction of 23.60% supports the continuation of the decline, and this comes as gold continues to obtain negative pressure from the 50-day simple moving average, accompanied by a clear decrease in momentum.

The expected direction for today’s session is still bearish, and the above technical factors enhance the chances of touching 1716 and 1708, respectively, knowing that 1700 is the official station for the current downside wave.

Activating the above-suggested scenario depends on the stability of daily trading below 1745, and surpassing it upwards leads gold to retest 1758.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations