The prices of the yellow metal incurred heavy losses during the trading session last Friday, under pressure from the rise of the US currency, to end its trading around 1762.

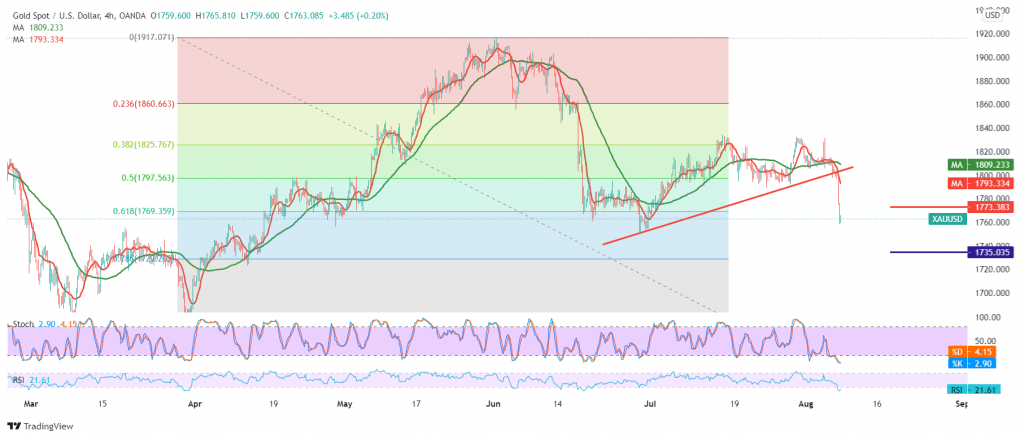

Technically, and by looking at the 4-hour chart, we find the continuation of the negative pressure is still valid, as a result of confirming the breach of the pivotal support level 1798, which has now turned into a resistance level, in addition to the negative pressure of the 50-day moving average.

Thus, we maintain our negative outlook, knowing that confirming 1762 numbers facilitates the task required to visit 1742 and 1735, expected initial stations that may extend later to visit 1722.

Note: The RSI is trying to provide bullish rebound signals that might lead gold prices to retest 1772/1775 before resuming the daily bearish trend again. In general, we continue to suggest the bearish trend unless we witness any price stability above 1798.

| S1: 1742.00 | R1: 1798.00 |

| S2: 1722.00 | R2: 1834.00 |

| S3: 1686.00 | R3: 1854.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations